Severance pay remains a critical concern for America’s growing independent workforce, with recent Upjohn Institute research revealing that contractors now comprise 15% of workers — double previous estimates. This surge in contractor numbers has sparked renewed debate about their rights and benefits, particularly regarding compensation at contract termination. The distinction between employee and contractor severance entitlements often confuses businesses and workers.

With 24% of American adults earning income through gig work, organizations increasingly use this flexible talent pool for specialized skills and project-based work. This shift has made understanding severance obligations essential for risk management and compliance. Recent changes in workforce dynamics, accelerated by remote work adoption and digital transformation, have highlighted the need for clear guidance on contractor compensation structures, including termination benefits. This article examines the complexities of severance pay for contractors, helping businesses and professionals navigate this crucial aspect of modern work arrangements.

In the United States, where 76.4 million professionals now work as freelancers, independent contractors are self-employed individuals who provide specific services or complete defined projects for clients. These professionals maintain control over their work methods, schedules, and equipment while operating under service agreements that outline deliverables and compensation terms. Unlike traditional employees, contractors typically manage multiple clients, issue invoices for completed work, and handle their own business operations.

The distinction between contractors and employees extends beyond basic work arrangements to fundamental operational differences. While employees work under direct supervision with provided tools and set schedules, contractors maintain autonomy over their business decisions, work processes, and client relationships. They bear responsibility for their own taxes, insurance, and business expenses, operating as independent business entities rather than subordinate workers. Here’s how to tell independent contractors apart from employees:

| Aspect | Contractors | Employees |

|---|---|---|

| Tax Responsibilities | Calculate their own taxes and tax deductions | Have their taxes withheld and paid by the employer |

| Eligibility for Statutory Benefits | Not eligible for statutory benefits (unless explicitly stated in labor legislation) | Entitled to receive statutory benefits (as per labor legislation) |

| Social Insurance Contributions | Make and manage their social insurance contributions | Social insurance contributions are withheld and managed by the employer |

| Working Hours and Methods | Choose their working hours and methods, work with other clients, and provide their tools and equipment | Work under employer authority, who sets working methods and provides necessary tools |

| Payment Method | Issue invoices for payment | Paid through payroll (usually monthly) |

Severance pay is a form of compensation provided to employees upon termination of employment. It generally serves as a financial cushion during the transition following their departure. The specifics regarding eligibility, amount, and severance pay conditions can vary significantly based on company policies, employment contracts, and local laws. For traditional employees, severance pay is often granted based on the length of employment and can be influenced by factors such as collective bargaining agreements and company policies.

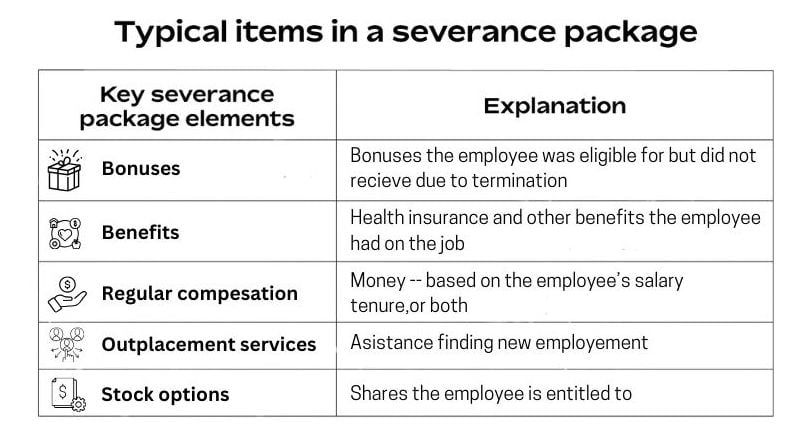

Companies offer different severance packages. Common severance package components typically include:

Pay

Most severance packages factor in the employee’s length of service and salary level. The standard calculation provides 1 to 2 weeks of pay for each service year, with executives and senior leaders often receiving enhanced compensation. Position level and industry standards typically influence the final severance amount offered.

Health benefits

Under COBRA regulations, employers must extend health insurance coverage for 18 months post-employment. While organizations aren’t required to cover premium costs, some choose to subsidize healthcare expenses temporarily to maintain positive relationships and support transitioning employees.

Retirement benefits

Retirement plan provisions in severance agreements may allow continued contributions during the severance period. Employees generally retain rights to transfer their retirement accounts upon departure, subject to plan-specific regulations.

Career transition support

Outplacement services represent a valuable severance component, providing professional job search assistance. These programs typically include resume optimization, interview coaching, and career development resources to help former employees secure new opportunities.

Additional benefits

Comprehensive severance packages might include extended access to company resources, such as retention of corporate devices, continued use of company vehicles, or ongoing fitness center memberships.

Do you have IT recruitment needs?

Severance pay for independent contractors differs significantly from that of traditional employees. Generally, contractors do not receive severance pay as part of their compensation packages since they are typically engaged under different contractual terms that do not mandate such benefits. Unlike employees whose severance pay may be negotiated based on company policy or employment contracts, independent contractors operate under agreements that outline their specific terms of engagement, which usually do not include severance provisions.

Contractors often work under fixed-term agreements or project-based contracts, which specify the scope of work, duration, and payment terms. These contracts typically include termination clauses that outline the conditions under which either party may end the agreement without incurring penalties. Therefore, when a contractor’s engagement concludes, it is generally viewed as the natural end of a contractual relationship rather than a termination that would warrant severance pay.

Severance pay is influenced by several factors, including the nature of employment contracts, organizational policies, legal considerations, and the specific circumstances surrounding the termination of employment.

The existence of an employment contract or company policy often dictates whether severance pay is offered and its amount. While severance pay is not mandated by federal law in the United States, many employers include it as a goodwill gesture in their employment agreements or company policies to support employees during their transition out of the organization. The terms of these contracts can vary widely, encompassing different calculations for severance packages, such as length of service, position, and salary.

Employers must also navigate various legal implications when determining severance pay. These include tax considerations, as severance pay may be subject to income tax, social security tax, and other withholdings, influencing how the payment is structured. Additionally, understanding state laws regarding employment rights and severance can be crucial, especially for contractors who may not have the same protections as regular employees.

The context in which termination occurs plays a significant role in determining severance pay. For instance, employees laid off due to economic downturns or organizational restructuring may receive more substantial severance packages to provide financial support during their job search. In contrast, employees terminated for cause may not be entitled to severance pay, depending on the conditions outlined in their employment contracts.

Another essential factor influencing severance pay is the continuation of benefits such as health insurance and retirement plans. Employers may extend certain benefits for a specified period as part of the severance package, which can significantly affect the overall value offered. This continuation of benefits is often critical for employees who rely on these resources during their transition period.

Clear communication regarding severance pay is essential for avoiding misunderstandings between employers and employees. Providing detailed explanations of severance calculations and answering any questions can foster a smoother transition and help maintain positive relationships, even in challenging circumstances.

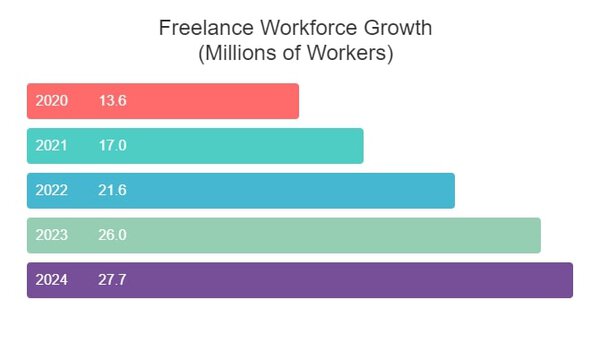

The gig economy represents a dynamic marketplace where independent contractors and freelancers engage in short-term work arrangements through digital platforms and direct client relationships. Currently valued at USD 556.7 billion in 2024, this sector is projected to reach USD 1847 billion by 2032, growing at a CAGR of 16.18%. This revolutionary work model encompasses various services, from ride-sharing and delivery services to specialized professional consulting, offering workers unprecedented flexibility in choosing their assignments and work schedules. This dramatic expansion is clearly illustrated in the freelance workforce growth data in the US:

This transformative shift in work patterns shows no signs of slowing. Independent workers now comprise 36% of employed Americans, up from 27% in 2016. Industry analysts project even more dramatic changes by 2025, with an estimated 70% of professionals working remotely at least 5 days a month and 40% of the global workforce operating from home. These trends signal a fundamental restructuring of traditional employment models, driven by technological advancement and changing worker preferences.

Recruitment agencies have evolved to bridge the gap between traditional employment models and the emerging gig economy landscape. While historically focused on permanent placements, these agencies now adapt their services to accommodate short-term, project-based assignments. By offering specialized support in contract negotiations, skill development, and networking opportunities, recruitment agencies serve as crucial intermediaries, helping businesses and independent professionals navigate the complexities of modern work arrangements.

Career matchmaking

Agencies leverage their expertise to connect freelancers with suitable projects, providing comprehensive guidance on portfolio development, application strategies, and interview preparation.

Rate optimization

Professional negotiation support helps independent contractors secure competitive compensation, with agencies offering market insights and rate benchmarking across various industries.

Contract management

Agencies simplify the complexities of freelance agreements by offering contract review services, clarifying terms, and ensuring workers understand their contractual obligations and entitlements.

Comprehensive Support

In addition to placement services, agencies provide holistic assistance, including professional development guidance, financial planning resources, and access to legal consultation.

When evaluating recruitment agencies for gig economy opportunities, professionals should consider these essential factors:

Industry focus

Choose agencies with expertise in freelance and contract placements within your sector.

Performance history

Evaluate the agency’s success metrics and client testimonials to ensure a proven track record of successful placements.

Market credibility

Research the agency’s standing through industry reviews and peer recommendations.

Professional alignment

Select an agency whose communication style and business approach align with your professional goals and working preferences.

DevsData LLC transforms traditional contractor recruitment through its specialized approach to connecting businesses with google-level engineering talent. Their recruitment expertise encompasses the full spectrum of contractor engagement, from initial screening to contract finalization, while providing crucial market insights on compensation structures and engagement models. As a boutique agency, they navigate the complexities of contractor relationships, ensuring both parties understand their obligations and expectations from day one.

DevsData LLC‘s impressive foundation includes an extensive database of 65000 pre-screened professionals built over 8 years of specialized experience. Operating from New York and Warsaw, DevsData LLC implements a rigorous selection process featuring 90-minute technical interviews and comprehensive problem-solving assessments. This meticulous approach results in an exclusive 6% acceptance rate, guaranteeing clients access to only the most qualified contractor talent. The company operates on a success fee model and provides a guarantee period for both permanent and contractor placements.

Their proven track record spans diverse industries, from hedge funds to innovative startups across the US and Israel, consistently earning perfect 5/5 client satisfaction ratings on Clutch and GoodFirms. With their government-approved recruitment license, DevsData LLC maintains transparent communication throughout the engagement process, helping businesses build successful long-term relationships with senior contractors while ensuring compliance with industry standards and best practices.

Do you have IT recruitment needs?

The financial implications of contractor agreements extend far beyond basic compensation, affecting both businesses and professionals throughout the engagement lifecycle. While contractors typically don’t receive traditional severance packages, working with knowledgeable recruitment partners can help establish clear terms and protect both parties’ interests in contract termination scenarios.

Navigating these complex arrangements requires specialized expertise, particularly in sectors like technology and finance, where contract work has become increasingly prevalent. Professional recruitment agencies bridge this gap by providing insights into market standards, compliance requirements, and best practices for contractor relationships, ensuring both parties are protected throughout the engagement.

DevsData LLC, with 8 years of specialized experience and a database of 65000 pre-screened professionals, expertly guides businesses through the contractor engagement complexities. Their thorough understanding of various employment arrangements, combined with a stringent 6% acceptance rate and consistent 5/5 client satisfaction ratings, makes them ideally positioned to assist with contractor relationships.

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Build your project with our veteran developers

Build your project with our veteran developers

Explore the benefits of technology recruitment and tailor-made software

Explore the benefits of technology recruitment and tailor-made software

Learn how to source skilled and experienced software developers

Learn how to source skilled and experienced software developers

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)