Understanding how much you can expect to earn is key when working in any country. In Poland, like many other countries, various factors such as tax rates, social security contributions, and insurance premiums can significantly impact your take-home pay. Poland has a progressive income tax system, meaning the tax rate increases as your income grows. If your annual income is up to PLN 120000 (USD 29005), you’ll pay a tax rate of 12%. However, if your income exceeds PLN 120000, the tax rate rises to 32%.

Whether you’re an employee with a formal contract or a freelancer working on a business-to-business (B2B) basis, knowing how much you’ll earn after all deductions is crucial for budgeting and financial planning. This is especially important for those new to the Polish job market or considering relocating to Poland, as salary expectations can vary depending on the type of contract and the sector in which you work. Thankfully, Poland has a range of salary calculators designed to simplify this process, helping you avoid any confusion and giving you clear insight into your income.

In this article, we’ve compiled a list of the top salary calculators you can use in Poland. These tools are essential for employees and freelancers, providing a straightforward way to calculate gross and net earnings. They help users account for the complexities of the Polish tax system, including mandatory contributions like social security and health insurance. For freelancers or anyone working under a B2B contract, these calculators also allow you to factor in additional variables such as VAT (Value Added Tax) and business expenses. Access to these calculators is important because they save you time and help you stay fully aware of your financial situation before making decisions about job offers, contracts, or freelance projects.

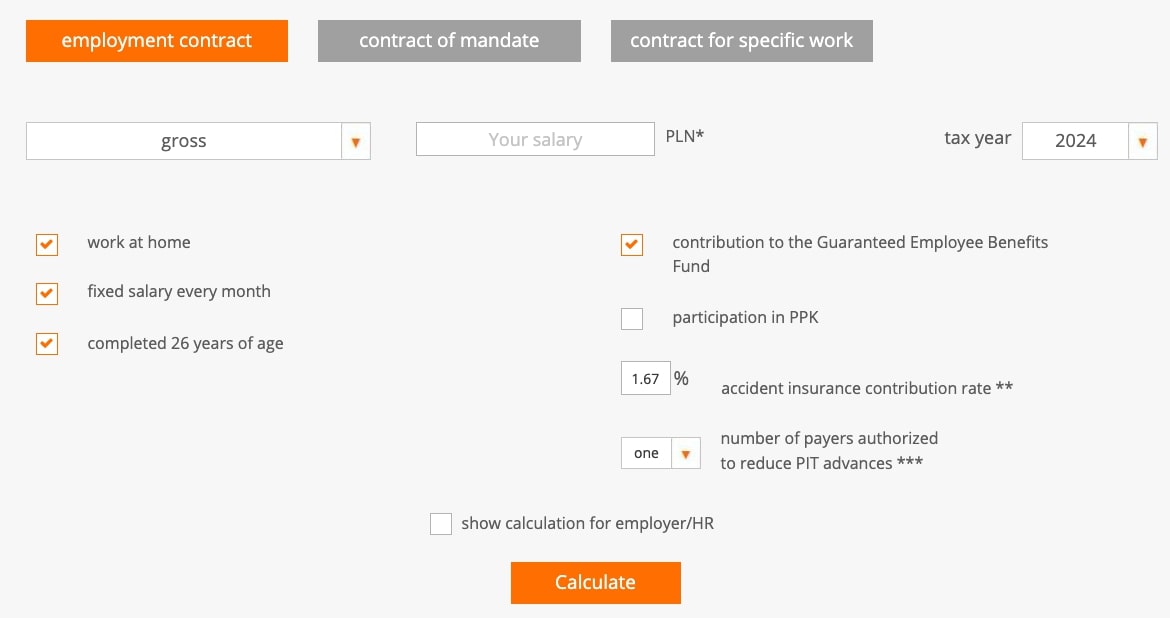

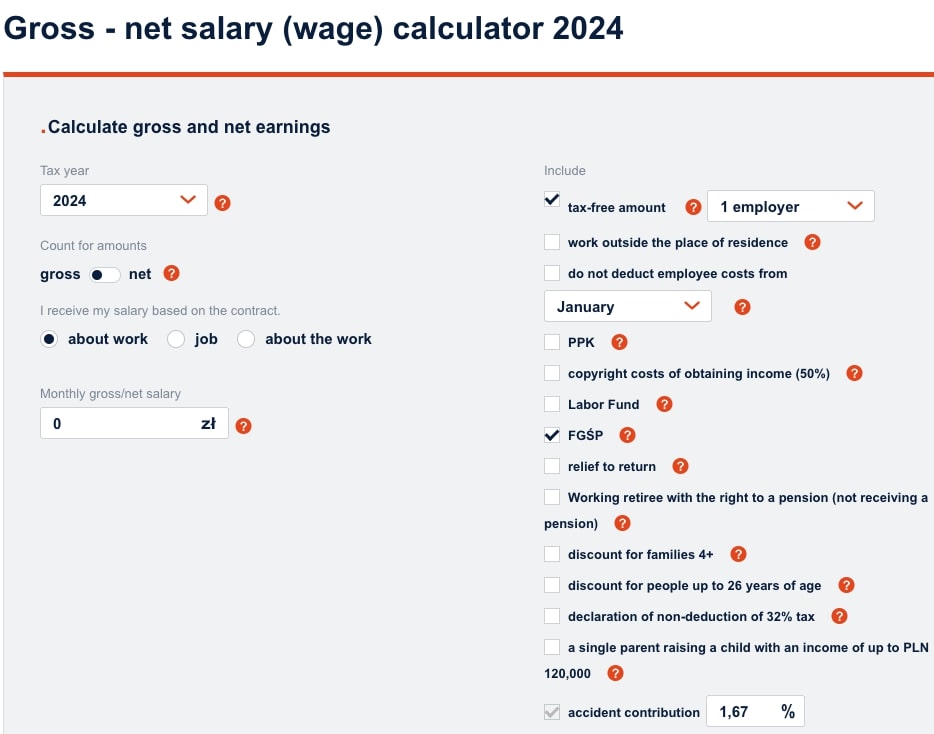

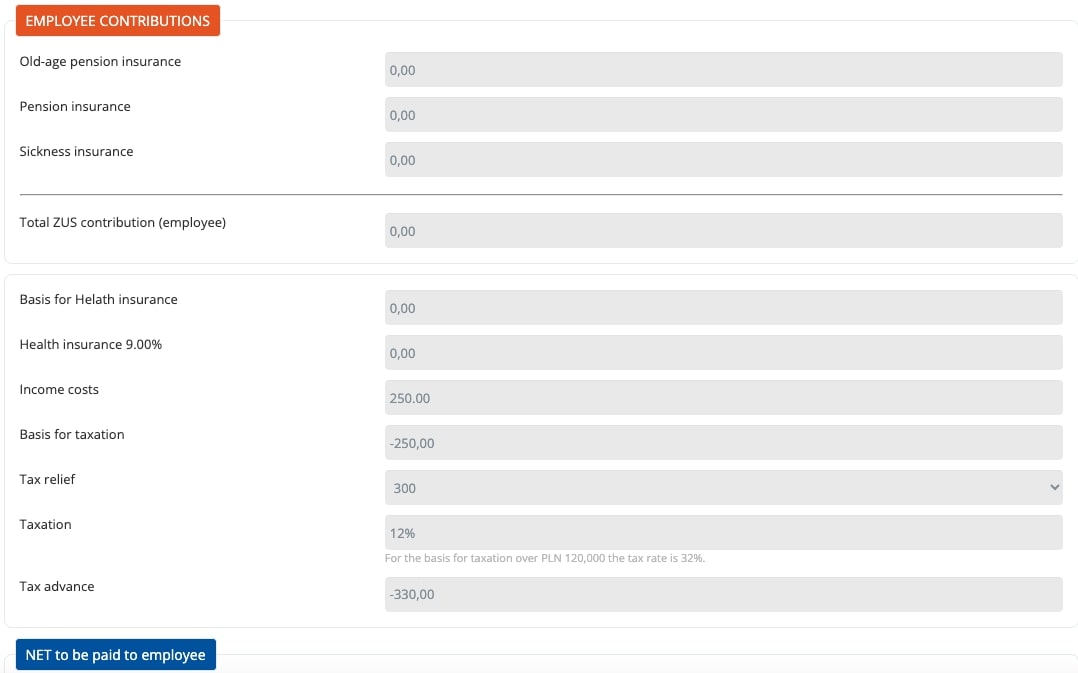

Wynagrodzenia is a leading platform in Poland for calculating salaries under formal employment contracts. This salary calculator is designed to help employees and employers estimate monthly earnings by considering the impact of taxes, social security contributions, and other statutory deductions. Users can calculate gross-to-net and net-to-gross salaries, offering clear insights into how much employees will take home after mandatory deductions. For employers, the tool is equally helpful in determining the overall payroll costs, ensuring that they can set appropriate salary expectations and comply with Poland’s tax regulations.

The calculator’s user-friendly interface makes it accessible to experienced professionals and those unfamiliar with the Polish tax system. It covers a wide range of job categories and salary structures, and users can adjust various parameters such as tax class, benefits, and work allowances to refine their estimates. Wynagrodzenia also offers detailed breakdowns of the deductions involved in calculating net pay, so it is easier for users to understand where their earnings are allocated.

Do you have IT recruitment needs?

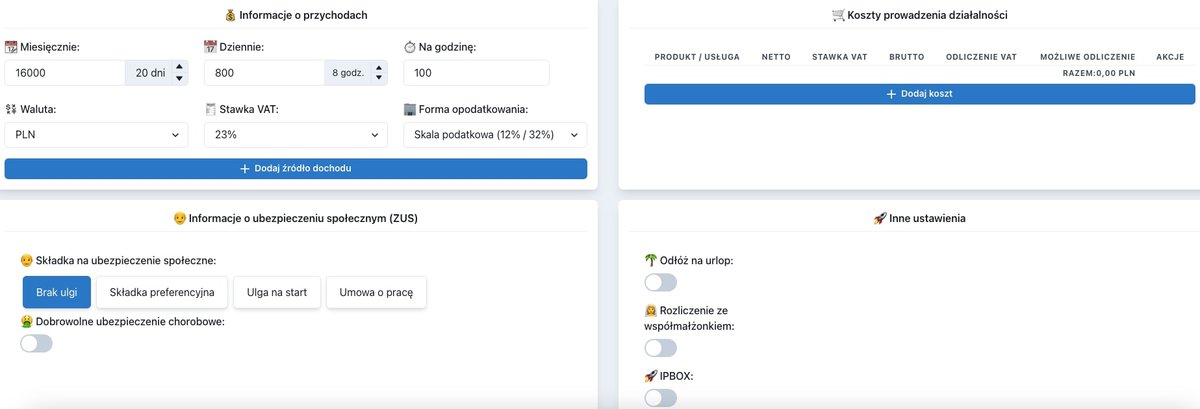

KalkulatorB2B is a tool designed for people working under B2B contracts in Poland. It helps freelancers, contractors, and consultants calculate their net income by factoring in taxes, social security contributions (ZUS), and other required deductions. The tool also considers important aspects of B2B contracts, such as VAT, business expenses, and health insurance, which is especially useful for independent workers and companies hiring contractors. Users can easily adjust their income and contract details to reflect different tax scenarios and expense structures.

The platform provides a clear breakdown of how much freelancers and contractors will earn after all mandatory payments, helping them set realistic salary expectations. KalkulatorB2B also compares various B2B contract types, offering insights into different tax and deduction options, which allows users to choose the most financially profitable contract based on their specific situation.

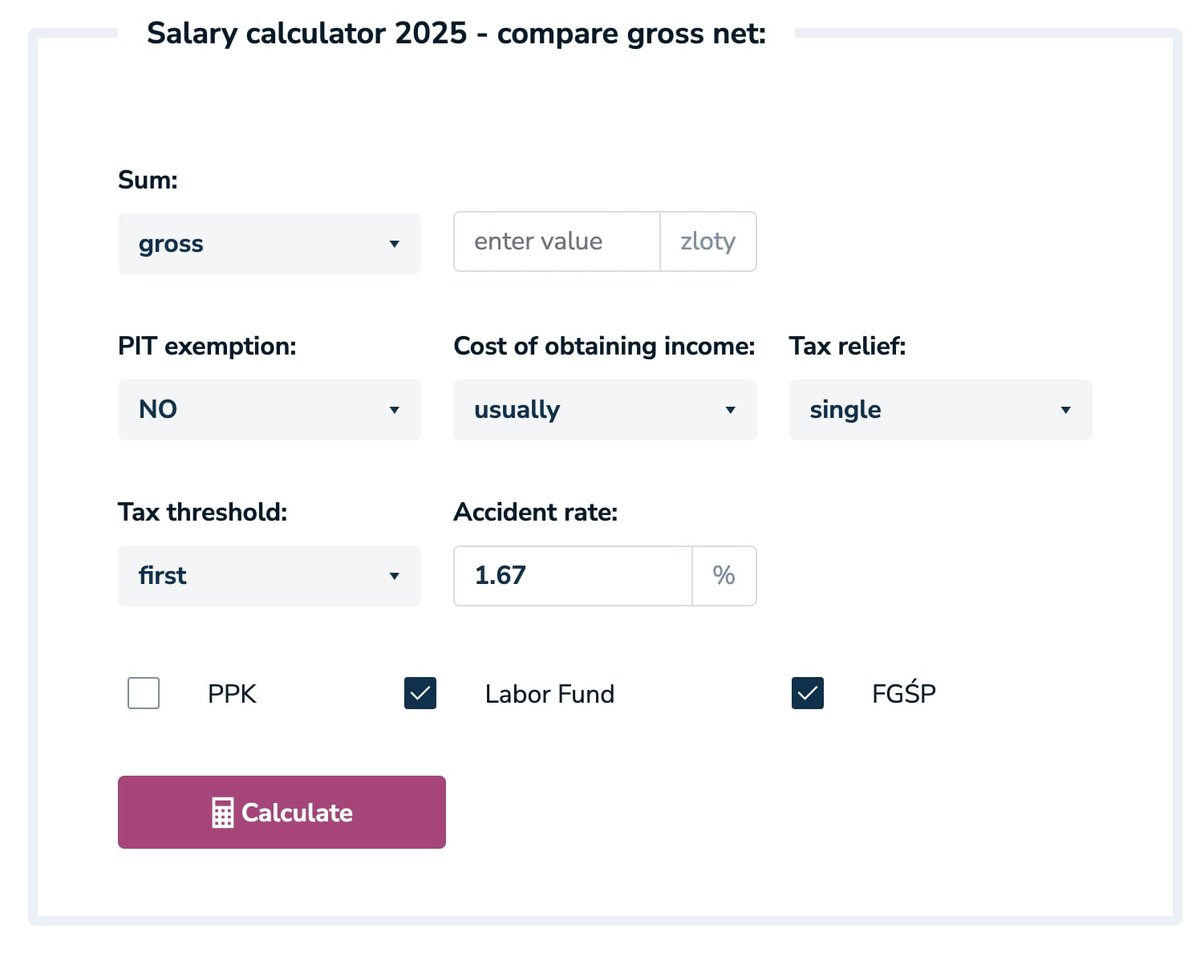

Poradnik Przedsiębiorcy is a comprehensive platform offering tools and resources to assist individuals and businesses in Poland. Its salary calculator is a standout feature, enabling users to compare gross and net salaries, calculate employment costs, and understand deductions such as taxes and social security contributions. This tool is particularly valuable for employers and employees looking to easily and accurately determine net pay and employment expenses.

Additionally, the platform provides a rich array of resources, including e-books, business advice, advertising tips, and legal information. Covering topics like accounting, taxes, human resources, and business law, these resources are designed to help businesses navigate the challenges of entrepreneurship and compliance in Poland. Whether you’re a startup founder or a seasoned entrepreneur, Poradnik Przedsiębiorcy offers valuable support for managing various aspects of running a business.

After exploring the top 3 salary calculators, let’s take a look at some additional options that can provide further clarity on salary calculations and tax obligations in Poland. Here’s a detailed look at some of the best alternatives:

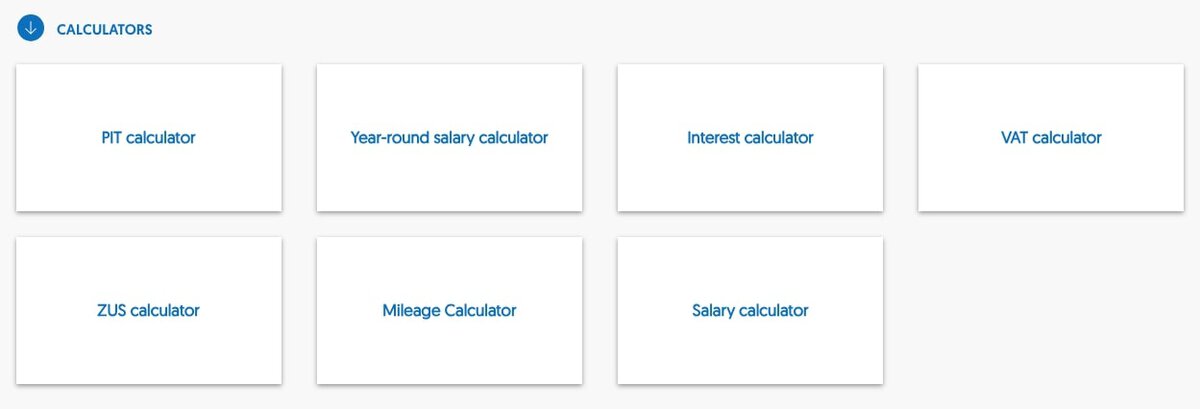

PIT offers a versatile salary calculator that caters to both formal employment and B2B contract scenarios. It provides a detailed overview of net income for employees under various employment models, including formal contracts and freelance or contractor agreements. The tool helps users understand their final income by accounting for taxes, ZUS contributions, and other mandatory deductions. PIT’s flexibility allows users to compare earnings under different contract types, making it ideal for contractors who need to evaluate the benefits of working under formal employment versus B2B arrangements.

Beyond just salary calculations, PIT offers additional calculators, such as the PIT calculator, year-round salary calculator, interest calculator, and VAT calculator. These tools help users manage their finances by providing accurate calculations for taxes, salary projections, interest rates, and VAT obligations.

PIT also provides resources on tax regulations and filing requirements, helping users navigate Poland’s complex tax system. This platform is particularly beneficial for individuals comparing different work scenarios, as it gives a comprehensive breakdown of employee and self-employed income calculations. For contractors and freelancers, it’s invaluable for understanding how various taxes and contributions impact earnings, while businesses can use it to offer competitive and fair compensation packages.

Do you have IT recruitment needs?

Bankier is a financial platform in Poland that offers a variety of tools and resources to help users manage their finances. Among its services is a salary calculator that helps users estimate their net income based on different scenarios, such as tax classes, social security contributions, and allowances. This tool is useful for employees and employers who want a better understanding of salary obligations and what can be expected after mandatory deductions are applied. The platform also allows users to adjust parameters such as tax class and benefits, helping them tailor their calculations to more specific employment situations.

Accace is a provider of payroll outsourcing, tax consulting, and accounting services in Poland and Central and Eastern Europe. Their salary calculator helps users estimate their net salary by factoring in tax deductions, ZUS contributions, and other mandatory payments, offering a clear breakdown of how these deductions are made. Beyond the calculator, Accace offers comprehensive payroll services, providing compliance with Polish labor laws for businesses of all sizes. They assist employers with managing payroll, calculating taxes, social security contributions, and developing competitive compensation packages while ensuring full legal compliance.

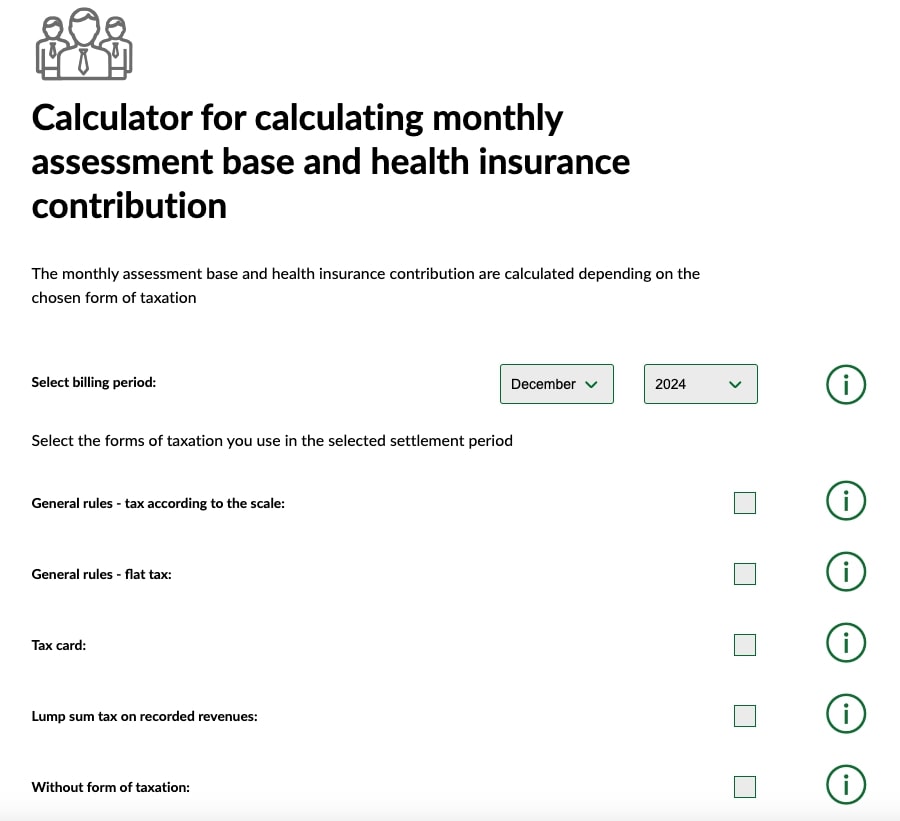

ZUS is focused on social security contributions, helping freelancers and employees understand their obligations. Although it primarily addresses social insurance requirements, it’s a valuable tool for anyone working in Poland who wants to track their social security contributions. This calculator offers insights into the specific ZUS payments required based on income levels, which helps users make the correct contributions. Moreover, it provides detailed guidance on how different income levels affect the required payments, allowing freelancers and employees to calculate their contributions and stay compliant with Polish regulations accurately.

While salary calculators can be helpful for both employers and employees, understanding local regulations is crucial, especially when working with contractors in Poland. One effective way to navigate this process is using an employer of record (EoR) service.

DevsData LLC is a leading IT recruitment agency and provider of EoR services with over 8 years of experience. The company specializes in managing Polish employment laws and facilitating compliant payment processing. With its headquarters in the US and Poland and offices in major Polish cities such as Warsaw, Krakow, Katowice, Gdansk, and Wroclaw, DevsData LLC offers expertise to businesses looking to hire contractors or establish operations in Poland.

DevsData LLC’s EoR services cover all aspects of employment law, HR advisory, and payroll management, which helps businesses remain compliant while focusing on growth. Their extensive experience allows them to offer tailored solutions that meet the unique needs of companies in various sectors.

In addition, DevsData LLC is a government-approved recruitment agency that follows a success fee model, meaning clients only pay when a candidate is successfully hired. Leveraging its global experience, the agency connects companies with top talent worldwide. It also offers a guarantee period, ensuring that if a hired candidate leaves within a specified time, DevsData LLC will find a replacement at no extra cost.

The agency has a database of over 65000 candidates and uses a rigorous interview process, including a 90-minute problem-solving challenge. Having completed over 100 projects for more than 80 clients, including global companies and startups in the US and Israel, DevsData LLC has earned 5/5 client satisfaction ratings on Clutch and GoodFirms.

DevsData LLC also provides business process outsourcing (BPO) services, which can greatly improve operational efficiency. By outsourcing payroll processing, HR administration, and accounting, companies can reduce costs, streamline their processes, and maintain regulatory compliance.

Do you have IT recruitment needs?

Whether you’re looking to pay contractors in Poland or optimize your business operations, DevsData LLC offers comprehensive solutions tailored to your specific needs. Visit DevsData LLC or contact them at general@devsdata.com to learn more about their services.

Salary calculators can be incredibly helpful for both employees and employers navigating the Polish job market. These tools provide valuable insights into potential earnings, helping individuals set realistic salary expectations and calculate competitive compensation packages for their teams. However, businesses can face challenges when determining accurate salary offerings, especially with fluctuating tax rates, local labor laws, and varying compensation structures across different types of contracts.

In these cases, considering an EoR service can simplify the process. An EoR provider like DevsData LLC handles all the legal and administrative tasks associated with employment in Poland. This includes managing payroll, ensuring compliance with local tax laws, and taking care of HR functions. By using an EoR, businesses can focus on growth while leaving employment-related challenges to experienced professionals.

DevsData LLC’s address in Warsaw:

DevsData IT Recruitment Agency Poland

Al. Jerozolimskie 181B,

02-222, Warsaw, Poland

poland@devsdata.com

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Build your project with our veteran developers

Build your project with our veteran developers

Explore the benefits of technology recruitment and tailor-made software

Explore the benefits of technology recruitment and tailor-made software

Learn how to source skilled and experienced software developers

Learn how to source skilled and experienced software developers

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)