The financial services and banking industry is evolving rapidly, driven by digital transformation, increasing regulatory demands, and rising consumer expectations. As a result, the demand for specialized roles like risk analysts, compliance officers, and FinTech developers is steadily growing, and companies are struggling to fill these critical positions.

“According to Forbes, 83% of financial leaders in 2024 reported experiencing a talent shortage, a notable rise from 70% in 2022.”

Similarly, a PwC study highlighted that 70% of financial services CEOs view the scarcity of skilled professionals as a significant risk to their company’s growth. Despite these challenges, fewer than 30% are actively investing in workforce adaptability.”

In an industry where precision, trust, and innovation are non-negotiable, the need for hiring the right people has never been higher. Recruiters relying on job boards and LinkedIn often fail to identify passive candidates with niche expertise and a deep understanding of regulations. As a result, an increasing number of financial institutions are partnering with specialized recruitment agencies to meet these unique demands.

In this article, we’ll explore the role of recruitment agencies in finance and banking, why partnering with experts can make all the difference, and how to navigate the hiring challenges unique to this sector. We’ll also highlight key trends shaping the talent market and discuss how DevsData LLC can support you in building a high-performing financial team with the right mix of skills, experience, and cultural fit.

The financial sector recruitment covers a wide range of roles, from traditional areas like commercial banking, investment management, and asset management, to emerging fields such as cryptocurrency, payment systems, and regulatory technology (RegTech).

“Hiring in finance and banking demands more than just a finance degree. It requires pinpointing professionals with deep specialized expertise at the intersection of finance and technology, tailored to each organization’s unique needs.”

Professionals need deep familiarity with complex compliance frameworks, such as Basel III, MiFID II, or SOX, and the intricate workings of various financial products, including derivatives and structured products. Additionally, a growing emphasis on technology in finance means that candidates must be proficient in tools commonly used in modern financial environments, such as Python, SQL, Bloomberg, and financial modeling software.

Recruiters in this sector often work with both large, established institutions and innovative startups, filling a variety of roles that require a combination of financial knowledge and specialized skills.

Given the high stakes and ever-changing landscape of the financial industry, recruitment agencies in this space are integral in sourcing top talent who can navigate the complexities of regulatory compliance, advanced financial instruments, and the latest technological advancements in finance.

The finance field covers a wide range of functions, from traditional banking and investment management to highly specialized areas like FinTech development and regulatory compliance. Each institution, whether it’s a global bank, a boutique investment firm, or a rising FinTech startup, has unique hiring needs.

Recruitment agencies that specialize in this space are equipped to fill a diverse array of positions across departments, levels of seniority, and technical focus areas. Below is a breakdown of some of the most commonly filled roles, categorized by function:

| Category | Description | Common Roles | Key Certifications / Skills |

|---|---|---|---|

| Risk & Compliance | Focuses on managing regulatory risks and ensuring the organization adheres to legal standards. |

– Chief Risk Officers (CROs) – Regulatory Reporting Managers – AML/KYC Specialists |

– CFA, FRM, CAMS – Regulatory knowledge (Basel III, FATCA) – Strong analytical/reporting tools (Excel, SAS) |

| Investment & Wealth Management | Involves managing client assets, making investment decisions, and providing financial advice. |

– Portfolio Managers – Investment Analysts – Traders & Quant Researchers |

– CFA – Bloomberg, Python/R for modeling – Quantitative analysis |

| Technology & Fintech | Covers roles at the intersection of finance and technology, driving innovation and digital transformation. |

– Full Stack Developers (Python, React, etc.) – Data Scientists & Engineers – Blockchain Developers |

– Python, React, Node.js – AWS, Kubernetes – Data tools (SQL, Spark, TensorFlow) |

| Finance & Strategy | Deals with financial planning, analysis, and strategic decision-making to drive business growth. |

– CFOs – FP&A Analysts – Controllers |

– CPA, CFA – Financial modeling (Excel, Power BI) – ERP systems (SAP, Oracle) |

| Operations & Support | Supports the execution and maintenance of daily financial operations and client services. |

– Client Onboarding Specialists – Middle Office Operations – Settlements Analysts |

– Knowledge of financial systems – Client service tools (Salesforce) – Accuracy and time management |

The table shows a clear breakdown of key functional areas within the financial sector, each defined by specialized roles, skill sets, and certifications necessary to meet their unique demands:

Do you have IT recruitment needs?

Recruiting top talent in the financial domain is no small feat. Whether you’re hiring for a FinTech startup or a global investment firm, several key challenges tend to stand in the way. These challenges are a key reason why many companies partner with specialized recruitment agencies—experts who understand the industry’s intricacies and can deliver faster, more accurate hiring while reaching top-performing, often inaccessible talent. Let’s take a closer look at what makes hiring in this industry so complex:

As the industry evolves with FinTech, digital banking, and advanced data analytics, there’s a growing demand for professionals who blend financial acumen with technical expertise. Roles in cybersecurity, blockchain, ESG reporting, and AI-driven analytics are particularly hard to fill, as few candidates possess both domain knowledge and hands-on experience. The vast majority of finance executives view cloud computing (80%), generative AI (78%), and emerging forms of AI (76%) as essential to strengthening business resilience, further intensifying the need for highly specialized talent. Generalist recruiters often struggle to identify or vet candidates for these niche positions, while specialized agencies understand which skills and certifications (e.g., CFA, FRM, CAMS) truly matter.

Hiring for roles that involve dealing with compliance, risk, or governance requires a deep understanding of evolving global regulations, such as MiFID II, GDPR, and Basel III, among others. Many generalist recruiters fall short here, resulting in mismatches or hiring delays. Financial institutions also need professionals who are familiar with region-specific rules, such as the Dodd-Frank Act in the US or the Prudential Regulation Authority in the UK. This makes it even more challenging to find candidates who not only meet the technical qualifications but are also well-versed in the specific regulatory landscape that governs their work. Agencies specializing in this sector can help bridge this gap by leveraging their expertise in these critical areas.

The best candidates often have multiple offers on the table, especially in hot markets like digital banking, asset management, and blockchain. With such high demand for skilled professionals, companies face significant pressure to stand out in a competitive job market. Without a compelling employer brand or a fast, decisive hiring process, companies risk losing out to competitors who can move quicker or offer more attractive incentives. It’s also essential for companies to focus on creating a workplace culture that appeals to top talent, as many candidates today place a high value on work-life balance, diversity, and opportunities for growth and advancement.

In finance, hiring someone who can do the job isn’t enough—they also need to mesh with the company’s culture, pace, and long-term goals. Misaligned hires lead to higher turnover, which is especially costly in regulated environments, where a single mistake can have serious repercussions. In a sector as fast-paced and high-stakes as finance, employees who don’t fit culturally may struggle to adapt to the demands of the role or the organization’s ethos, leading to disengagement and eventual attrition. Agencies that understand your company’s culture and the specific dynamics of the financial sector are better equipped to identify candidates who are not only technically skilled but also a good fit for your team.

As the industry changes, so do the expectations around hiring. Understanding the latest trends can help companies stay ahead and attract senior-level talent in a competitive market.

Financial institutions are no longer just competing with each other; they’re also competing with technology companies. Traditional players, such as JPMorgan Chase, Goldman Sachs, and Citigroup, are heavily investing in digital platforms, launching mobile-first services, and partnering with or acquiring FinTech startups. For example, Goldman Sachs acquired personal finance app Clarity Money, while Visa and Mastercard have made significant FinTech acquisitions (e.g., Visa’s purchase of Tink).

These shifts have created demand for hybrid professionals, such as product managers with banking experience or software engineers with expertise in payments and compliance. Recruiters now prioritize candidates who can think like entrepreneurs, code like developers, and operate like bankers.

Do you have IT recruitment needs?

The pandemic accelerated remote work adoption, and for many roles, particularly in tech, compliance, risk, and even trading, it’s here to stay. Financial services firms are increasingly offering hybrid or fully remote roles to attract top talent, particularly those with tech and data backgrounds. Major financial institutions such as Deutsche Bank, UBS, and Wells Fargo have adopted hybrid or fully remote models for selected functions.

Candidates now expect more than a competitive salary—they value autonomy, flexibility, and work-life balance. Firms unwilling to adapt risk missing out on strong candidates, particularly among younger professionals and in-demand engineers.

Artificial Intelligence (AI) is rapidly transforming various sectors, and financial services are not an exception. Many organizations, such as HSBC, Bank of America, and JPMorgan Chase are incorporating AI into their talent management strategies, particularly to address the ongoing challenge of talent shortages in finance. By investing in AI-driven technologies, companies can streamline their recruitment processes, improve data analysis, and automate routine tasks, freeing up HR professionals to focus on high-priority projects that require human judgment.

Additionally, AI-powered tools like chatbots are being used to answer frequently asked questions, significantly speeding up candidate selection and freeing up recruiters’ time. For companies in the financial sector, adopting AI can help them stand out as innovative employers, making them more appealing to tech-savvy, top-tier talent. This not only enhances recruitment efforts but also aligns organizations with cutting-edge trends in technology, ensuring they stay competitive.

Cybersecurity has become a critical focal point for the financial industry as digital transactions, online banking, and financial data management increasingly move to the cloud. With frequent cyberattacks and data breaches dominating the news, the need for skilled cybersecurity professionals in the finance and banking sectors has never been more urgent. These positions are not only desirable but also essential for protecting sensitive financial data and maintaining customer trust.

The field is particularly vulnerable to cyber threats due to the high value of the data it handles, including personal and financial information. As a result, cybersecurity roles in the sector are expanding beyond traditional IT departments to include specialized positions in risk management, security architecture, and compliance.

In response to growing threats, institutions like Barclays, Morgan Stanley, and BNY Mellon have expanded their security teams significantly. Capital One, after facing a major data breach, heavily invested in hiring top-tier cybersecurity experts and building a more robust cloud security infrastructure.

Many firms are now prioritizing diversity not just as a legal requirement or a box to check, but as a competitive advantage that drives innovation, creativity, and better decision-making. For example, research over the past decade shows that companies with greater gender diversity on their executive teams are increasingly likely to outperform financially. In fact, organizations in the top quartile for gender diversity are now 39% more likely to achieve superior financial results compared to their less diverse peers, more than double the advantage reported just eight years ago.

“Inclusive hiring goes beyond meeting quotas—it fosters a culture where all employees feel valued and empowered. Diverse leadership improves business performance and attracts top talent.”

With growing pressure from stakeholders, companies are embedding DEI into every stage of recruitment, gaining an edge in workplace culture, talent attraction, and retention.

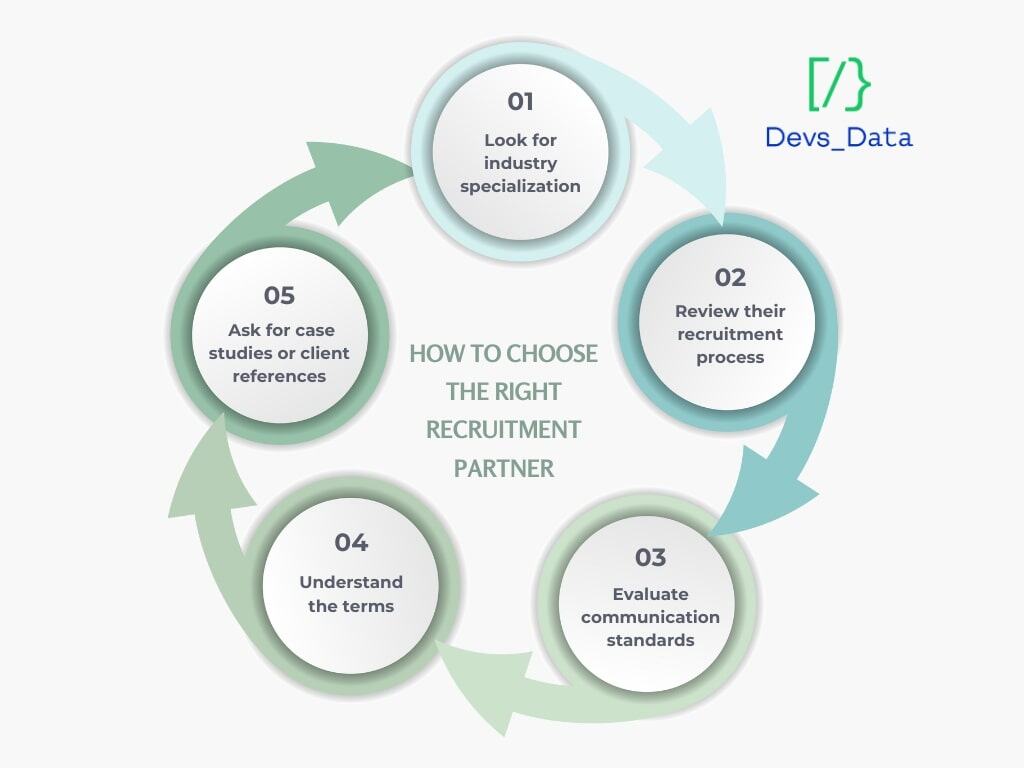

Hiring a recruitment agency is a strategic decision. It’s not just about outsourcing hiring tasks. It’s about choosing a partner that understands your goals, your industry, and your standards. Here’s how to do it right:

The effectiveness of a recruitment agency is closely linked to the quality and reach of its talent network. In specialized financial roles, general recruitment methods often fall short.

Reputable agencies maintain extensive networks, not only of active job seekers but also of passive candidates—high-performing professionals who may not be actively searching but are open to compelling opportunities. This is particularly critical in areas such as FinTech, cybersecurity, risk management, and investment strategy, where top-tier talent is limited and highly selective.

Evaluate whether the agency has a proven track record in your domain. Inquire about the depth of their talent pool, the types of roles they most frequently fill, and their ability to support hiring at mid, senior, and executive levels.

An agency’s approach to recruitment is a clear indicator of its commitment to quality. A strong process should be structured, transparent, and adaptable to your internal workflows.

Request a detailed overview of their process from candidate sourcing to final delivery. High-performing agencies don’t rely solely on job postings. Instead, they actively source candidates through curated networks, industry-specific communities, and referrals.

Review how they assess candidates. Do they use technical assessments, role-specific case studies, or structured behavioral interviews? Ask whether their evaluation process aligns with your organization’s standards and timelines.

In high-stakes hiring, clear and consistent communication is essential. A reliable recruitment partner should keep you well-informed and aligned throughout the process.

Discuss how frequently updates will be shared and what kinds of reporting you can expect. Strong agencies typically provide candidate pipeline summaries, interview feedback, and sourcing statistics to help your team stay on track.

It’s also important to understand how they manage unforeseen delays or timeline changes. A professional agency will proactively raise concerns, provide realistic timelines, and maintain transparency throughout the engagement.

Before committing, take time to fully understand the agency’s terms of service, pricing model, and delivery expectations. Transparency at this stage lays the foundation for a productive partnership.

Recruitment firms may operate on different models. Some use a contingency structure where fees apply only if a hire is made, while others use a retained model that involves upfront payment for dedicated searches. For example, DevsData LLC uses a success-fee model, charging only when a candidate is successfully placed. They also offer a guarantee period, meaning they will replace a hire at no extra cost if the candidate does not meet expectations.

Ask about expected time-to-fill, communication frequency, and how they handle adjustments. A professional agency will be forthcoming about these details and committed to maintaining accountability throughout the engagement.

Past performance is one of the most reliable indicators of future results. Ask for examples that demonstrate the agency’s ability to deliver high-quality hires in contexts similar to your own.

A reputable firm should be able to share case studies or client testimonials that highlight their success in placing specialized roles, the speed and quality of their delivery, and the support they provided throughout the process. For instance, the next section includes case studies from DevsData LLC, highlighting their experience in sourcing talent for a finance company.

This type of evidence is especially valuable when hiring for confidential roles or scaling a new department. It shows that the agency has solved similar challenges and can back up its approach with real results.

Website: www.devsdata.com/

Company size: ~60 employees

Founding year: 2016

Headquarters: Brooklyn, NY, and Warsaw, Poland

DevsData LLC is a leading recruitment agency with over 8 years of experience helping companies in the financial services and banking sector find highly skilled tech and business talent. The company was founded by a former engineer from Goldman Sachs’ technology department, who has a strong background in investment banking. This foundation gives DevsData LLC a deep, firsthand understanding of the fast-paced, high-stakes nature of financial institutions and the kind of talent they require.

DevsData LLC has successfully delivered recruitment projects for top hedge funds, venture capital firms, and regulated financial institutions across the United States, Europe, and Asia, including:

With a deep understanding of the industry’s unique demands, including regulatory compliance, risk management, and digital transformation, DevsData LLC delivers tailored hiring solutions that align closely with clients’ goals and operational needs. The agency has extensive experience recruiting top-tier technical talent, including senior software developers, data engineers, AI experts, and senior data scientists.

Combining deep market insight with a data-driven approach, DevsData LLC manages the entire recruitment process, from initial sourcing and screening to final placement. The company holds a government-approved license for recruitment services, reinforcing its credibility and compliance with international hiring standards. Clients benefit from immediate access to a global network of over 65000 pre-vetted professionals, supported by a team of more than 40 experienced recruiters based in the United States and Europe. Every candidate undergoes a rigorous 90-minute technical interview and detailed role-specific evaluation, ensuring a strong match in both skillset and cultural alignment.

Specializing in high-demand areas such as AI, machine learning, and data science, DevsData LLC helps clients build agile, high-performing teams. The agency operates on a success-fee model and includes a guarantee period, during which any necessary candidate replacements are provided at no additional cost. DevsData LLC is consistently recognized for delivering high-quality results, maintaining 5/5 client satisfaction ratings on industry platforms such as Clutch and GoodFirms.

Over the years, DevsData LLC has led numerous high-impact recruitment projects in this industry. These engagements showcase the agency’s ability to navigate complex hiring challenges and deliver exceptional results under tight deadlines and demanding requirements.

DevsData LLC partnered with a London-based FinTech company specializing in algorithmic trading on cryptocurrency exchanges. The client sought tech leads with advanced algorithmic skills and experience in finance or hedge funds. Leveraging its understanding of financial systems and regulatory requirements, DevsData LLC executed a global search, employing targeted sourcing, technical pre-assessments, and live coding interviews. This tailored strategy led to the placement of 4 skilled engineers and the establishment of a new engineering branch in Poland, surpassing the initial goal of hiring one programmer.

NewCoast Group, a multi-strategy family office that was founded in 2014, collaborated with DevsData LLC to recruit a backend developer for its trading systems. The role demanded expertise in Python, data engineering, Kubernetes, and financial markets. Through a streamlined, multi-stage recruitment process, the agency identified a Serbian developer who met the technical and domain-specific requirements. The hire integrated seamlessly into NewCoast’s US trading operations, delivering significant value and reinforcing DevsData LLC’s expertise in FinTech recruitment.

Do you have IT recruitment needs?

To explore how DevsData LLC can support your hiring needs in this sector, visit www.devsdata.com or reach out a general@devsdata.com.

Finding the right talent in the financial services and banking sector isn’t just about filling roles. It involves securing highly skilled professionals who possess the expertise to navigate complex, regulation-heavy environments, master evolving financial technologies, and adapt swiftly to rapid market changes. Given the critical importance of precision, compliance, and innovation in this sector, organizations require individuals who not only meet technical qualifications but also demonstrate a deep understanding of industry-specific challenges and risks. Specialized recruitment agencies play a vital role in this process by connecting financial institutions with high-caliber candidates who combine both domain expertise and the ability to deliver meaningful business impact. Their nuanced understanding of the sector’s unique demands enables them to identify talent capable of supporting long-term growth, regulatory adherence, and digital transformation initiatives.

DevsData LLC stands out with over 8 years of experience in recruitment and consulting. They’ve helped financial institutions—from FinTech startups to global banks—build strong, reliable teams. But their support doesn’t stop at recruitment. DevsData LLC also provides Employer of Record (EoR) services, allowing businesses to hire and manage remote teams globally while staying fully compliant with local employment laws. Their Business Process Outsourcing (BPO) services further simplify operations, freeing up internal resources to focus on strategy and revenue.

You can watch the video below to learn more about their recruitment services.

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Build your project with our veteran developers

Build your project with our veteran developers

Explore the benefits of technology recruitment and tailor-made software

Explore the benefits of technology recruitment and tailor-made software

Learn how to source skilled and experienced software developers

Learn how to source skilled and experienced software developers

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)