The financial technology (FinTech) sector is undergoing rapid transformation, fueled by both evolving consumer expectations and significant technological advancements. Financial technology, or FinTech, refers to the use of software, algorithms, and digital tools to improve or automate financial services. It spans areas such as digital banking, payment processing, online lending, personal finance management, and blockchain-based systems. As digital banking, decentralized finance, and embedded financial services continue to reshape the industry, businesses are increasingly turning to skilled FinTech developers to build innovative and secure digital solutions. Whether it’s creating real-time payment systems, integrating AI-powered analytics, or enhancing transaction transparency with blockchain, FinTech developers are at the forefront of this evolution.

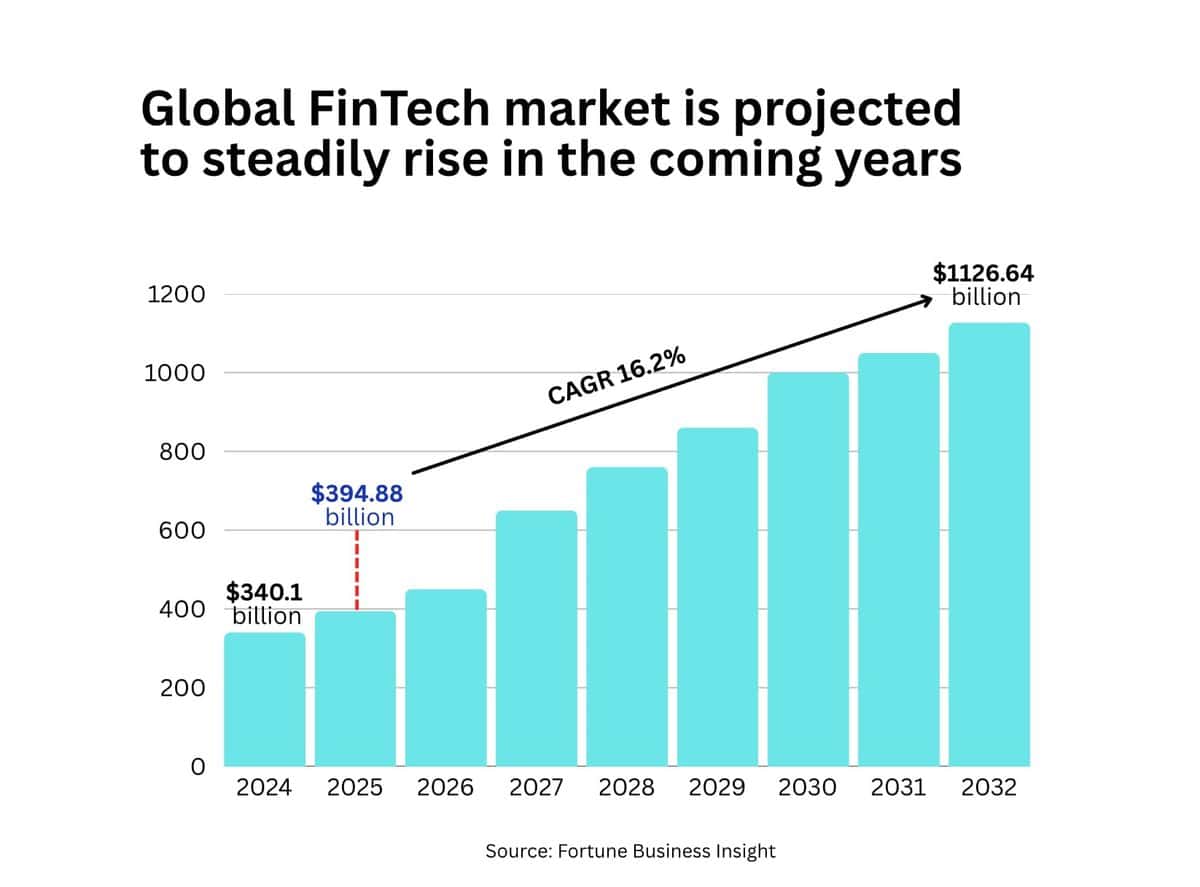

The current market growth reflects this momentum. In 2024, the global FinTech market was valued at $340.10 billion. It is projected to rise to $394.88 billion in 2025 and reach $1126.64 billion by 2032, expanding at a compound annual growth rate (CAGR) of 16.2% during the forecast period. This growth is driven not only by consumer demand but also by the efficiency gains offered by cutting-edge technologies. For example, blockchain adoption in finance, particularly for transactions that require multi-ledger coordination among banks, has already reduced infrastructure costs by 30%, resulting in savings of $8 to $12 billion.

In such a dynamic landscape, hiring the right FinTech developer can be a game-changer. These professionals help businesses design and implement systems that meet strict compliance requirements while remaining scalable, secure, and user-friendly. However, finding candidates with the right mix of technical knowledge, domain expertise, and regulatory awareness remains a challenge. This article will provide an overview of practical insights in recruiting FinTech developers, compare hiring models, outline key challenges, and explain how DevsData LLC can support clients in navigating this complex process.

Building successful FinTech products requires more than just an idea; it takes specialized engineering talent with a deep understanding of both financial systems and modern software development. Hiring FinTech developers brings critical capabilities in-house, allowing businesses to build secure, compliant, and scalable products that meet complex industry demands.

FinTech developers combine software engineering skills with financial knowledge, enabling them to build applications tailored to industry requirements. Their understanding of instruments like derivatives, lending workflows, or payment rails allows them to make product decisions grounded in domain logic. This reduces miscommunication between business and tech teams and shortens the feedback loop in product development.

Experienced FinTech engineers know how to choose and implement technologies that suit specific product goals, whether it’s for digital wallets, trading platforms, or fraud detection systems. They’re often already familiar with popular frameworks and APIs used in the financial sector, from Plaid to FIX protocols. This means less time spent onboarding and more time building.

Hiring developers with FinTech experience ensures that security and compliance are not afterthoughts. From the start, they design systems to handle sensitive data responsibly, implement regulatory requirements like KYC or PCI DSS, and prepare the product for scrutiny from auditors, partners, or investors. Their awareness of evolving regulations also helps future-proof your product roadmap.

FinTech systems often handle high transaction volumes and operate in real time. Developers with experience in this space understand the importance of system performance, uptime, and fault tolerance, critical to customer trust and business continuity. Their code is often optimized from day one for scalability, preventing costly rewrites down the line.

Having FinTech developers on your team means you’re not outsourcing core technical decisions. This reduces dependency on third-party vendors, makes iterations faster, and helps you retain institutional knowledge over time. In-house developers also tend to have a deeper sense of ownership, which translates into higher-quality code and long-term product stability.

“In a market where demand outpaces supply, companies that streamline their hiring process and know what to test for gain a clear advantage in attracting top FinTech talent.”

Do you have IT recruitment needs?

Hiring a FinTech developer is a pivotal decision that can significantly impact your project’s success. Depending on your organization’s specific needs, budget, and project scope, there are several effective hiring models to consider:

Building an internal team of FinTech developers offers direct oversight and seamless integration with your company’s culture and processes. This model is ideal for organizations seeking long-term commitment and consistent collaboration. However, it requires substantial investment in recruitment, training, and infrastructure. Additionally, the competitive market for skilled FinTech professionals can make attracting and retaining top talent challenging.

Engaging freelance FinTech developers provides flexibility and cost-effectiveness, especially for short-term projects or specific tasks. Freelancers can be sourced globally, allowing access to a diverse talent pool. However, this model may present challenges in terms of reliability, communication, and alignment with your company’s objectives. Ensuring quality and consistency requires thorough vetting and clear contractual agreements.

Partnering with an external agency or assembling a dedicated team offers a comprehensive solution for FinTech development. This model provides access to a wide range of expertise, including developers, designers, and project managers, all coordinated to deliver your project efficiently. Outsourcing can be particularly beneficial for complex or large-scale projects, offering scalability and resource optimization. However, it necessitates careful selection of a trustworthy partner and clear communication to ensure alignment with your goals.

Each of these hiring models has its advantages and considerations. Your choice should align with your project’s requirements, budget, and desired level of control. Here’s a table comparing the models for you to evaluate and understand which one is the best fit for your business:

| Hiring Model | Pros | Cons | Best for |

|---|---|---|---|

| In-House Hiring |

|

|

Long-term projects with ongoing needs and larger budgets |

| Freelance Developers |

|

|

Short-term tasks or temporary workload spikes |

| Outsourcing and Dedicated Teams |

|

|

Mid to large-scale projects, startups, or companies without internal Here’s a clear salary overview across regions, all in USD. These are Glassdoor-based averages and may vary by seniority or company profile. tech teams |

Here’s a clear salary overview across regions, all in USD. These are Glassdoor-based averages and may vary by seniority or company profile.

| Region | Average Annual Base Salary (USD) |

|---|---|

| US | $114000–$159000 |

| Europe | $48000–$58000 (e.g., UK, Germany, Eastern Europe) |

| LatAm | $30000–$40000 |

| India | $8000–$12000 |

| Model | Avg. Annual Cost (US) | Benefits | Decision Considerations |

|---|---|---|---|

| In-House | $150000–$200000 (incl. benefits) | Budget stability, cost amortized over long-term strategic roles | High fixed costs: salaries, benefits, office space, and long hiring cycles |

| Outsourcing | $8000–$60000 (depending on the outsourcing destination) | Lower labor costs, no infrastructure spending | Cost varies by region; hidden vendor management and coordination expenses |

| Freelance Contractor | $20000–$80000 (depending on a freelancer’s location) | Pay-per-task; no overhead or long-term commitments | Unpredictable costs due to hourly rates and inconsistent availability |

Hiring goes far beyond salary. The Society for Human Resource Management puts average external recruitment at around $4700 per reorder, but for FinTech, this can be multiples of that. Onboarding new engineers takes 3–6 months to reach full productivity, costing $5000–$7000 per hire just in training, paperwork, and equipment. Effective onboarding in FinTech also demands domain-specific mentoring and compliance training, adding time and effort before independence.

Salaried employees in the US come with around 30–40% extra costs, covering payroll taxes, insurance, retirement match, and office expenses. For a $126000 base, that’s $38000–$50000 of extras annually. On top of that, in-house hires require ongoing support for professional development, which is crucial for FinTech compliance, data privacy, and evolving regulatory demands.

Tech turnover averages around 23–35% annually; the number is even higher in FinTech. Each departure can cost 1–2x salary, factoring in lost productivity, re‑hiring, knowledge transfer, and team disruption. For a $126000 salaried dev, that adds $125000–$250000 in indirect costs. Minimizing turnover means investing in career paths, technical growth, and culture.

This model brings flexibility but requires active oversight. Costs include setting up secure development pipelines, ensuring vendor compliance with data privacy, scheduling calls across time zones, and legal coordination. The business should expect to budget 5–10% of project cost for contract negotiations, timezone alignment, and integration.

While cheaper per hour, freelancers may leave mid-project or have competing priorities. The business needs to invest in vetting for secure coding and IP agreements. Each disruption can delay release and affect code continuity, requiring duplicated management efforts that can offset hourly rate savings.

FinTech developers must combine strong technical foundations with specialized domain knowledge. This unique mix ensures they can build secure, compliant financial systems that scale. Here’s a closer look at what makes them stand out:

FinTech developers often rely on Python and Java for backend systems due to their robust ecosystems and reliability in financial processing. Python is also widely used in AI-driven applications, such as fraud detection, credit scoring, or algorithmic trading, thanks to powerful libraries like TensorFlow and scikit-learn. On the frontend, JavaScript and TypeScript are essential for building responsive, user-friendly financial interfaces. For latency-sensitive systems such as high-frequency trading, C++ and Go are common choices due to their speed and efficiency. In blockchain-based projects, developers often use Solidity for smart contract development on Ethereum, and Rust for building secure, performant applications on platforms like Solana.

On the backend, frameworks like Spring Boot and Node.js enable secure API and microservice architectures. Frontend frameworks (React, Angular, Vue) are widely used in modern UI development for fintech dashboards. Blockchain developers need Solidity and Ethereum tools for smart contracts. Meanwhile, containerization with Docker, orchestration via Kubernetes, and cloud infrastructure (AWS, GCP) are critical for delivery resilience. CI/CD pipelines and infrastructure as code help ensure compliant deployments.

FinTech apps often combine transactional and analytical data. Skilled developers are proficient in PostgreSQL, MongoDB, Redis, and use SQL, as well as NoSQL. They understand ACID compliance, replication, and secure data encryption.

Superior FinTech developers know the underlying business needs, like payments, FX, and trading systems, and strict regulations: PCI-DSS, GDPR, KYC/AML. They design with data security in mind, utilizing encryption, secure authentication, and audit logging at every layer.

“Hiring FinTech developers means prioritizing both technical skills and domain knowledge; generalist experience alone often falls short in regulated, high-stakes environments.”

In FinTech, having visually compelling, performant dashboards is essential. These platforms often involve real-time data feeds, interactive charts, and complex analytics, making data visualization not just aesthetic but mission-critical. A well-crafted visual interface can enhance user comprehension and productivity, and in finance, clear data presentation can support faster insights and better decision-making. Use cases range from live portfolio monitoring to payment analytics, requiring tools that can render millions (even billions) of data points smoothly.

Developers often rely on libraries like D3.js for visualizations. Its flexibility, interactivity (tooltips, zoom/pan), and compatibility with SVG, HTML, and CSS make it a go-to choice for finance dashboards. For example, institutions like The New York Times and Getty have created intricate financial visualizations using D3. However, designing effective dashboards demands careful attention to user context, reducing cognitive load and tailoring interactions.

On the frontend framework side, React remains the dominant choice in FinTech, combining performance, reusable UI components, and strong ecosystem support. React is widely used by FinTech platforms like Coinbase and Robinhood, because of its scalability, efficient rendering, and real-time UI updates via WebSockets. Today, React is second to top framework among developers, with a 39.5% usage share across websites. Its virtual DOM and component model are well-suited for handling dynamic financial workflows.

That said, performance tuning is vital, optimizing bundle sizes, code-splitting, memoization, and virtual DOM strategies ensure rich interfaces remain fast, even under heavy data loads. For FinTech companies aiming to blend usability, performance, and data integrity, prioritizing skilled frontend engineering and visualization expertise is foundational.

Do you have IT recruitment needs?

The integration of AI tools into FinTech development workflows has rapidly increased over the past few years, reshaping how engineers approach code writing, debugging, and architectural decisions. Tools like Cursor, Claude Sonnet, and platforms such as OpenRouter are now commonly used to assist with tasks ranging from automated documentation to real-time code generation. According to a recent survey, 53% of financial services companies already use AI to optimize internal IT operations, including software development. However, while AI-assisted programming offers clear productivity gains, it’s not without challenges, especially in sectors as sensitive and regulated as finance.

Legacy systems, stringent compliance standards, and the high cost of errors make FinTech development a poor fit for blind reliance on AI. Code generated or modified by AI tools must be extensively reviewed by senior engineers to avoid security vulnerabilities, performance issues, or integration mismatches. In particular, financial applications dealing with transactions, analytics, or personal user data require precision and auditability that many AI models are not yet equipped to guarantee. A Stanford’s Center for Research on Foundation Models found that code-generation models often hallucinate functions or introduce subtle bugs, especially in larger or interconnected codebases. This makes it crucial to pair AI use with a skilled development team capable of spotting these anomalies.

When implemented correctly, however, AI can accelerate development timelines, automate repetitive tasks, and assist with technical decision-making, especially in greenfield projects or frontend-heavy builds. Still, it takes a mature engineering culture to integrate these tools without compromising code quality. For FinTech companies, this means hiring developers who are not only familiar with traditional programming practices and financial domain logic but also comfortable critically evaluating AI-generated output.

DevsData LLC specializes in recruiting developers for FinTech projects, drawing on deep knowledge of the sector’s unique hiring challenges. This allows for targeted candidate selection and faster placements that align with both technical and domain-specific requirements.

Finding developers with both domain expertise and technical skills is difficult in FinTech. The sector demands not only strong coding proficiency but also an understanding of financial systems, regulatory compliance (e.g., KYC/AML), and secure data handling. Many developers have strong generalist backgrounds but lack experience with the specific requirements of financial applications. This mismatch can result in poorly designed systems that fail to meet regulatory or performance standards.

We vet candidates not just for technical excellence but also for their exposure to FinTech environments. Our recruitment process includes domain-specific screening tasks and scenario-based interviews that test for understanding of payment systems, financial APIs, and data security best practices. We also maintain a curated database of engineers who have worked on banking apps, crypto platforms, and trading software. This ensures that every placement meets both technical and industry-specific requirements from day one.

Security and compliance are non-negotiable, yet many developers lack hands-on experience with secure coding practices. FinTech applications are prime targets for cyberattacks, and any vulnerability can result in major financial and reputational damage. Developers who are not trained in secure development protocols may unintentionally introduce risks related to data encryption, API exposure, or third-party integrations.

We assess developers for their knowledge of secure coding practices, including OWASP guidelines and secure API handling. During the hiring process, we test for real-world problem-solving in scenarios involving encryption, authentication, and sensitive data processing. For ongoing projects, we support teams with code reviews focused on security, compliance audits, and access to security consultants. This proactive approach reduces risk and ensures our solutions meet industry standards for data protection and regulatory compliance.

High competition for FinTech talent often leads to long hiring cycles and costly bidding wars. Companies struggle to attract and retain developers with experience in modern FinTech stacks like Node.js, TypeScript, Python, or Solidity. Delays in hiring slow down product timelines and increase costs, especially for startups working against tight funding milestones.

We maintain a ready-to-engage network of pre-vetted FinTech developers across regions, enabling us to fill roles quickly without compromising quality. By sourcing talent from both the US and emerging markets like Eastern Europe and LATAM, we reduce hiring friction and cost. Our global reach, combined with ongoing engagement with candidates, allows us to present suitable matches within days, not weeks. We also support clients with market insights to build competitive offers that attract top-tier engineers without excessive spending.

“Security, compliance, and performance aren’t optional in FinTech; they’re baseline requirements that must be addressed from the first lines of code.”

Over the past decade, DevsData LLC has built a strong track record in FinTech and finance-related recruitment, delivering tailored solutions to high-stakes clients operating in complex regulatory and technical environments. One notable example is our ongoing collaboration with Kroll, Inc., a global risk and financial advisory firm, for which we’ve executed a series of backend and big data development projects over a 9-year period. Our work has involved assembling teams capable of handling distributed systems, regulatory compliance, and high-throughput data processing, all within sensitive financial contexts. Another example is our partnership with Caladan.xyz, a proprietary investment fund, where we played a key role in launching their European presence, building a local team of around 25 senior-level professionals from scratch.

To better illustrate how DevsData LLC operates within FinTech, let’s break down its collaboration with a London-based investment fund.

Tasked with sourcing top-tier engineers for a firm specializing in algorithmic cryptocurrency trading, the challenge was clear: Identify candidates with exceptional algorithmic problem-solving abilities and a deep understanding of financial systems.

The client sought engineers of tech lead caliber, preferably with backgrounds in the financial sector or hedge funds. The expectations encompassed not only technical prowess but also a profound grasp of the intricacies of financial trading systems.

To meet these stringent requirements, DevsData LLC mobilized a dedicated team of three recruiters and launched a comprehensive, multi-channel sourcing strategy. This approach extended beyond local talent pools, reaching into Asia, Eastern and Western Europe, and the United States.

The recruitment process was deliberately rigorous:

Initially aiming to hire a single developer, the client’s confidence in the quality of candidates presented led to the hiring of four engineers. This success prompted the establishment of a new engineering branch in Poland, underscoring the effectiveness of DevsData LLC’s recruitment strategy.

Beyond finance-specific engagements, DevsData LLC has provided end-to-end recruitment and development services to a wide range of SaaS companies, many operating in FinTech-adjacent or data-sensitive environments. These collaborations have spanned various stages of growth, from early MVP development to scaling engineering teams post-funding, and have included tackling complex technical challenges such as multi-tenant architecture, secure global infrastructure, and deep product integrations. Notable examples include:

Across all projects, we’ve refined a recruitment methodology tailored to the specific demands of SaaS and FinTech development, emphasizing high availability, secure architecture, compliance readiness, and scalability. This experience continues to inform how we source and evaluate talent capable of thriving in data-intensive, fast-paced digital environments.

Do you have IT recruitment needs?

Company size: ~60 employees

Founding year: 2016

Website: www.devsdata.com

Headquarters: Brooklyn, NY, and Warsaw, Poland

DevsData LLC is a trusted partner for businesses seeking skilled FinTech developers. With over 9 years of experience in the recruitment industry, the company has successfully completed over 100 projects for over 80 businesses. Whether the need is for building complex trading platforms, secure mobile banking apps, or scalable data-driven systems, DevsData LLC specializes in sourcing developers with the technical and domain-specific expertise FinTech demands.

What sets DevsData LLC apart is its dual presence in the US and Europe, with in-house US-based specialists on the team. This allows the agency to work closely with clients across time zones while maintaining global reach. Their track record includes successful collaborations with both corporate clients and high-growth startups from countries such as the US, Israel, and several EU nations. With a talent pool of over 65000 pre-vetted candidates, the agency is well-positioned to respond quickly to even the most specific hiring needs.

DevsData LLC operates under a government-approved license for recruitment services and follows a success fee model; clients only pay when the right hire is made. Each candidate goes through a rigorous evaluation process, including a 90-minute problem-solving challenge that tests real-world technical aptitude. Strong communication skills are also a priority, ensuring that candidates can integrate seamlessly into international teams.

This combination of sector focus, global coverage, and structured evaluation makes DevsData LLC a strong partner for FinTech hiring. The agency understands the specific demands of the industry, from regulatory compliance and security to domain knowledge and performance under scale, and aligns its recruitment process to meet those standards. Businesses benefit not only from fast access to specialized talent but also from a process built around long-term fit and reduced hiring risk.

To reduce hiring risk, DevsData LLC offers a guarantee period, allowing clients to replace a hire if needed. The company’s dedication to quality and results is reflected in its 5/5 client ratings on Clutch and GoodFirms. For businesses looking to hire FinTech developers with confidence, DevsData LLC brings a combination of technical rigor, global recruitment experience, and personalized service.

For more details and inquiries, contact DevsData LLC at general@devsdata.com or visit their website at www.devsdata.com..

The demand for skilled FinTech developers continues to grow alongside the rapid expansion of the global financial technology market. With projections showing the industry reaching over $1.1 trillion by 2032, businesses are increasingly turning to cutting-edge technologies like blockchain, AI, and real-time analytics to remain competitive. Whether it’s building secure payment gateways, developing mobile-first banking apps, or integrating compliance and data security features, FinTech developers play a vital role in shaping the future of digital finance.

Hiring the right developer, however, is not without challenges. From choosing between in-house, freelance, or agency models to navigating highly specialized technical requirements and regulatory constraints, the recruitment process requires a strategic approach. The most effective hiring methods involve thorough screening processes, cultural fit assessments, and technical evaluations tailored to FinTech needs. Organizations that succeed in this space typically rely on expert recruitment partners who understand both technology and finance at a deep level.

DevsData LLC stands out as one such partner. With more than 9 years of experience, a network of over 65,000 vetted candidates, and a rigorous 90-minute technical assessment process, the company has built a reputation for delivering top-tier FinTech talent. Their success fee model and government-approved recruitment license make them a low-risk, high-reward choice. DevsData LLC also brings added value through its US-based specialists, global client reach, and commitment to long-term hiring success, as reflected in consistent 5/5 ratings on Clutch and GoodFirms.

For more details and inquiries, contact DevsData LLC at general@devsdata.com or visit their website at www.devsdata.com..

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Build your project with our veteran developers

Build your project with our veteran developers

Explore the benefits of technology recruitment and tailor-made software

Explore the benefits of technology recruitment and tailor-made software

Learn how to source skilled and experienced software developers

Learn how to source skilled and experienced software developers

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)