Banking and finance professionals are the backbone of London’s economy, shaping capital allocation, managing risk, ensuring regulatory compliance, and delivering the analysis leaders rely on. The city’s status as one of the world’s foremost financial hubs magnifies these demands. London has ranked as the #1 global financial centre for five consecutive years, according to the City of London’s Global Offer to Business 2025 report. Its financial district alone generated £110.8 billion in GDP in 2023, a level comparable to entire national economies such as Morocco or Slovakia. This concentration of opportunity translates directly into competition: the City of London accounts for one in every five financial-services jobs in Great Britain, reinforcing how aggressively employers compete for top performers.

Against this backdrop, hiring elite talent becomes uniquely challenging. Credentials alone rarely capture what matters most in high-stakes finance roles. In London, where regulatory requirements shift quickly and markets move in real time, success depends on analytical agility, judgment under pressure, and cultural fit. A candidate may hold an ACA or CFA yet still struggle when confronted with ambiguous compliance scenarios, complex cross-border reporting, or high-frequency trading environments. Traditional hiring frameworks that rely on CV screening or generic interviews miss these deeper signals, leading to costly mismatches that erode controls, delay delivery, and weaken stakeholder trust.

The scale and concentration of opportunity in London raise the bar even further. The City of London alone accounts for about one in every five financial-services jobs in Great Britain (21%), underscoring how intensely competitive the local market is for top performers.

At the same time, the national pipeline remains tight: the Office for National Statistics recorded 34000 vacancies across financial and insurance activities in 2024, a persistent indicator of demand outpacing supply in key roles from risk and compliance to treasury and capital markets.

These pressures, combined with regulatory complexity, rapid digitisation, and international competition for specialists, make precision in hiring critical. A misaligned placement can compromise controls, delay initiatives, and diminish stakeholder confidence.

At DevsData LLC, we specialize in sourcing and placing elite banking and finance talent for London: from front-office and treasury to risk, finance, and COO/change roles. In this article, we’ll unpack our proven methodology, share real-world case examples, and offer practical guidance to help you build teams that deliver strategic clarity, regulatory confidence, and durable growth.

Banking and finance recruitment is about securing professionals who can thrive in one of the world’s most demanding financial hubs. Front-office talent, from investment bankers to traders, must combine analytical speed with client-facing agility under constant pressure. Middle- and back-office specialists, risk managers, compliance officers, and operations leaders, form the control backbone that keeps institutions secure and FCA/PRA-compliant. On the corporate finance side, CFOs, controllers, treasury specialists, and auditors safeguard liquidity, reporting, and long-term financial strategy.

What makes London unique is the convergence of scale, competition, and change: regulatory shifts, digital transformation, and a crowded global talent market. Successful recruitment here means validating not only credentials but also judgment under scrutiny, fluency with modern financial technologies, and the ability to adapt quickly in a sector where reputations and capital move fast.

London’s financial sector relies on diverse specialists, from front-office dealmakers to risk and control functions. Each role requires distinct technical and behavioral strengths. The table below highlights the most common positions and what sets high performers apart.

| Role | Core responsibilities | Key traits |

|---|---|---|

| Investment Bankers | Advise on M&A, capital raising, and complex deals shaping markets. | Financial modeling, negotiation, market insight |

| Risk Managers | Identify and mitigate financial, operational, and market risks. | Analytical rigor, regulatory awareness, resilience |

| Compliance Officers | Ensure adherence to AML laws, governance, and regulatory standards. | Integrity, detail focus, communication with regulators |

| Financial Analysts | Evaluate investments, forecast performance, support capital allocation. | Quantitative skills, trend analysis, strategic insight |

| Treasury Specialists | Manage liquidity, funding, FX, and capital optimization. | Precision, cross-border financial fluency, adaptability |

| Controllers / Finance Managers | Lead reporting, budgeting, and scalable financial processes. | Accuracy, systems thinking, reliability |

| CFOs | Shape financial strategy, investor relations, and long-term planning. | Leadership, vision, integration of tech/sustainability |

| Auditors | Review records, test controls, ensure transparent reporting. | Independence, compliance rigor, stakeholder trust |

| Private Equity and Asset Managers | Manage funds and portfolios, drive growth in investments. | Strategic evaluation, technical finance expertise |

| Corporate and Retail Bankers | Deliver tailored services to individuals and businesses. | Client relationship management, product knowledge |

These roles collectively uphold financial stability and regulatory confidence. Knowing their differences helps employers design sharper assessments and avoid costly mis-hires in a competitive market.

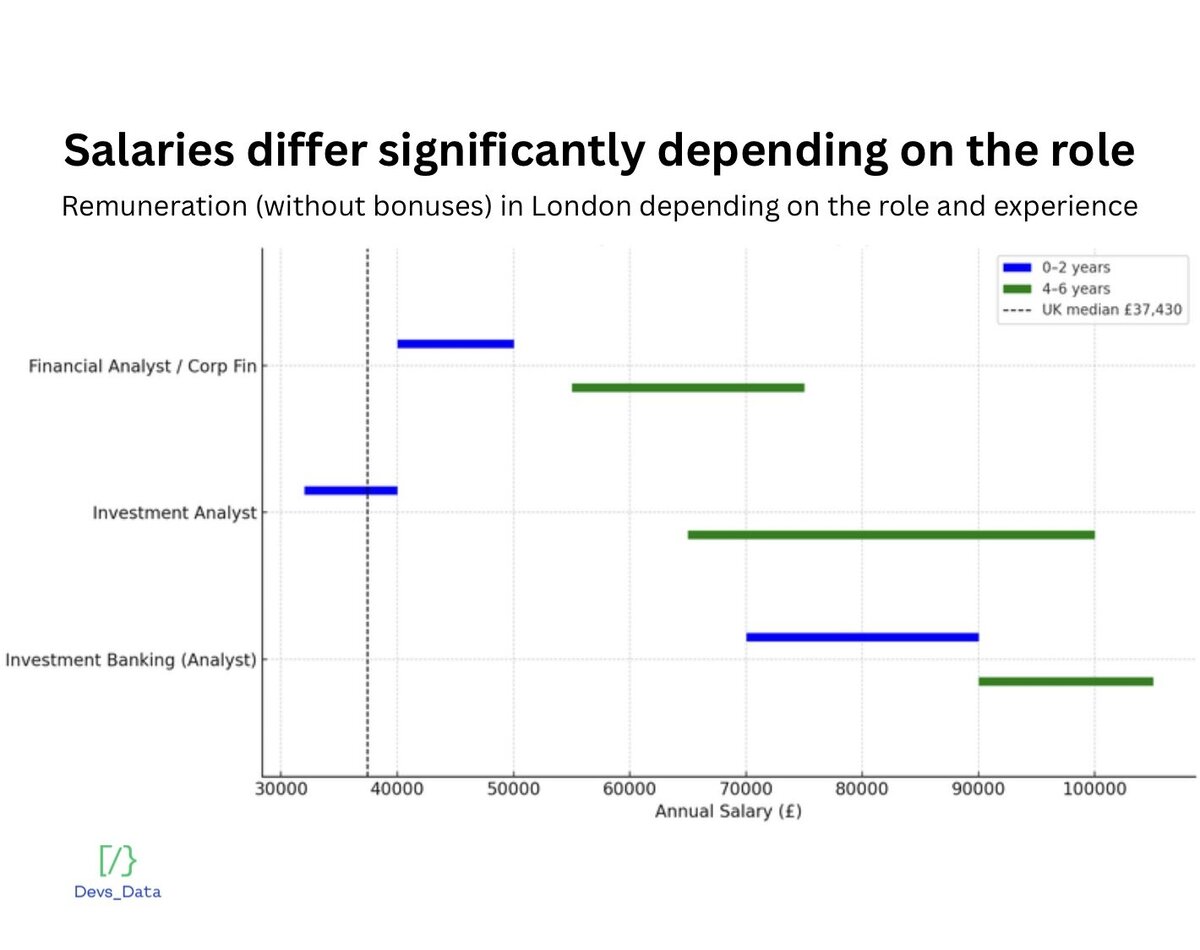

London’s financial sector is among the highest-paying in the UK, but compensation varies dramatically by role, seniority, and bonus structure. Below is a snapshot of recent, independently sourced data (2023-2025) to help ground expectations.

In the UK overall, median full-time gross earnings reached £37430 in April 2024 (≈ £728/week). However, London’s salaries tend to be substantially higher than the national median: the capital consistently leads in median wages among UK regions, with one source estimating London’s median around £47455 in 2024.

This London premium is particularly steep in the finance sector. According to a Michael Page report, accounting and financial services roles in London earn, on average, £20000+ more than the same roles elsewhere in the UK. For example:

Investment Banking (Analyst / Associate / VP tiers):

Industry reports for 2023 show base salaries for London banking roles clustering in ranges like £65000 for junior analysts, up to £105000 for associates or VPs, before bonuses. A commentary on investment banking compensation suggests analyst base salaries in London commonly fall between £70000-£90000, with median bonuses around £40000.

Financial Analyst / Corporate Finance roles:

Glassdoor data for London shows median total compensation (base salary plus additional pay) of around £44169 / year for finance analyst positions. Another source indicates typical finance analyst salaries in London hover near £47026 base. These roles often receive bonus components as well.

Junior / Graduate Investment Analyst:

According to Prospects, graduate investment analyst roles in London often start between £32000 and £40000 (plus bonuses), with mid-level analysts reaching £65000 to £100000+ depending on firm and performance.

The data makes one point clear: London carries a structural pay premium across nearly all finance roles. Even mid-level positions sit well above UK medians, while front-office and specialist roles show wide spreads due to performance-linked bonuses. At the top end, boutique and elite institutions skew compensation sharply upward.

For employers, this means salary bands must be calibrated carefully, misaligned ranges slow hiring and increase offer rejections in a competitive market. For candidates, the benchmarks highlight where advanced skills in regulation, capital markets, analytics, and technology command the strongest premiums.

London’s finance sector leaves little room for hiring mistakes. Specialized recruitment adds discipline to the process, using sector-specific assessments, compliance checks, and global sourcing to raise quality and reduce risk. The key benefits include:

Specialized recruiters build assesment (e.g., compliance scenario reviews, treasury cash-flow exercises) and pair them with validated assessments to surface real capability, not just credentials.

Evidence shows assessments raise hiring quality: 78% of HR professionals said pre-employment assessments improved the quality of their hires.

Specialized recruitment reduces fraud risk by verifying past audit experience, testing candidates on real control scenarios, and confirming their track record with regulators and external auditors. This ensures firms hire individuals who understand how to design, document, and enforce effective internal controls. According to ACFE’s 2024 global study, weak or overridden controls were the main causes of fraud, while most cases were uncovered through tips, highlighting the importance of experts who can design robust controls and whistleblowing frameworks.

Specialized recruiters embed UK regulation into the screening process. They review candidates’ work on FCA filings, SMCR responsibilities, AML investigations, and control frameworks, and use scenario-based tests to evaluate how they would respond to UK-specific compliance issues. This ensures companies hire leaders who already understand the UK regulatory landscape. With the SEC filing 784 enforcement actions in 2023, a year-on-year rise, hiring the right specialists through targeted recruitment directly reduces the likelihood of penalties and costly remediation. In the UK, the Financial Conduct Authority’s 2023/24 enforcement cycle resulted in 12 financial penalties totaling over £42 million for governance, systems & controls, and financial crime failings. More recently, in 2024/25 the FCA issued £186.4 million in fines against 16 firms and 13 individuals, a sharp escalation that highlights how UK enforcement is intensifying.

For London employers, these trends show why securing compliance leaders through targeted recruitment isn’t optional, it directly reduces the likelihood of costly remediation, reputational damage, and regulatory penalties.

Dedicated banking/finance recruiters maintain cross-border pipelines, for example, professionals holding globally recognized accounting certifications such as ACCA (Association of Chartered Certified Accountants) or CPA (Certified Public Accountant), as well as access to shared-service hubs and nearshore teams. This accelerates time-to-fill when talent is in short supply. A 2024 report cited by The Accountant notes that, on average, 32% of UK firms report shortages in financial, professional and business services skills, underscoring structural gaps in accounting and finance capacity and the need for specialised, global search strategies (Professional and Business Services Council / Financial Services Skills Commission, 2024). In parallel, UK financial services job vacancies averaged around 33000 in the first three quarters of 2025, broadly unchanged from the year before, signalling sustained demand for finance talent even as firms struggle to fill roles.

Precision hiring reduces backfills and downstream costs (onboarding, re-recruiting, remediation). Avoiding even a single failed hire in a critical banking role prevents duplicated spend and disruption; structured interviews, work samples, and rigorous reference calibration help get it right the first time.

Despite London’s strength as a global finance hub, employers face structural challenges that complicate hiring. These issues shape both talent availability and the level of scrutiny applied to financial roles. Key pressures include:

Undergraduate interest in accounting, the backbone of many finance functions, has fallen sharply, narrowing the entry-level funnel just as demand stays elevated. UK accountancy student numbers have slightly declined recently: According to the Financial Reporting Council’s Key Facts and Trends in the Accountancy Profession 2025 report, student numbers in the UK and Republic of Ireland decreased by about 0.3% between 2023 and 2024, continuing a modest downward trend in the pipeline of future accountants and finance professionals.

How we handle it at DevsData LLC

We widen the pipeline by targeting strong UK university programs in accounting, finance, and analytics, including institutions such as London School of Economics (LSE), University of Warwick, University of Manchester, University of Edinburgh, and University of Bath, and engaging students through career events, project-based collaborations, and internship-to-hire opportunities. We also use skill-based screening to surface high-potential candidates from adjacent majors (economics, math, data/analytics) who can be trained into finance roles.

Even after the post-pandemic peak, openings in Financial and Insurance activities remain elevated by historical standards, keeping competition intense.

UK vacancies averaged in the mid-30000s in 2024 and continued around 32-35k through 2025 H1, well above pre-pandemic lows, according to the Office for National Statistics.

How we handle it at DevsData LLC

We run parallel searches across geographies, maintain live shortlists of pre-vetted candidates (risk, compliance, treasury, FP&A), and keep “evergreen” sourcing active for roles with predictable churn, compressing time-to-fill in tight markets like London.

In the UK, pathways to key finance credentials and regulations are evolving in response to professional and market pressures. According to the Financial Reporting Council’s Key Facts and Trends in the Accountancy Profession 2025, student numbers across major UK and ROI accountancy qualification bodies fell by 0.3% between 2023 and 2024, signaling tightening pipelines into regulated professions such as audit and chartered accounting at the same time demand remains elevated. In addition to qualification trends, professional bodies are updating training and eligibility frameworks: for example, the Institute of Chartered Accountants in England and Wales (ICAEW) introduced new ACA training and assessment regulations effective 1 July 2025, which redefine eligibility and approved training conditions for the UK’s core chartered accountancy qualification. These shifts illustrate how credentialing complexity and regulatory expectations are changing in the UK market.

How we handle it at DevsData LLC

We map candidates’ eligibility against UK qualification frameworks up front, verify their progress through bodies such as ACCA, ICAEW, CIMA, or AAT, and provide hiring managers with clear guidance on training requirements, expected competencies, and timelines to full professional status, reducing downstream risk and aligning expectations in regulated finance roles.

Banks and finance teams are adopting AI for tasks from fraud/Anti-Money Laundering (AML) detection to research synthesis, but leaders warn of operational and third-party risk, and ROI is uneven so far, demanding new skills in oversight and model governance. This creates a hiring challenge: organisations now need professionals who can not only use AI tools but audit, govern, and challenge them, a skill set that is still relatively scarce in the finance talent market.

How we handle it at DevsData LLC

Our role definitions and scorecards explicitly test for tech fluency (ERP, BI, Python, and SQL where relevant), model-governance mindset, and the ability to audit AI-generated outputs. We also segment searches for “modern finance” profiles (FP&A + data) to future-proof teams.

Choosing the right recruitment partner is critical in a market as regulated and competitive as London. The points below outline what hiring leaders should look for to ensure strong outcomes and avoid costly mis-hires.

A credible agency should demonstrate proven experience in banking and finance, not just generic recruitment. Review case studies, client references, and successful placements in roles like risk management, compliance, treasury, or capital markets. Agencies with real London financial-sector engagements can better navigate FCA, PRA, and international regulatory nuances.

Our experience at DevsData LLC

We have delivered placements across London’s finance sector, including risk, compliance, treasury, capital markets, and CFO/Controller functions, supported by case studies that document our work with banks, funds, and financial-data organizations. Our teams operate with direct familiarity with FCA/PRA considerations and UK regulatory expectations.

Look beyond promises of “top talent.” Ask how the agency evaluates candidates, do they use case studies, technical role-play (e.g., treasury liquidity exercises, compliance scenario audits), or behavioral interviews calibrated to financial environments? Agencies with structured, finance-specific vetting reduce mis-hires and deliver higher retention.

Our experience at DevsData LLC

We design role-specific assessments for every finance engagement: treasury cash-flow tests, AML/compliance scenario reviews, capital-markets reasoning tasks, and accounting/audit work samples. This approach consistently identifies candidates who can operate under real constraints, not just those who interview well.

Banking and finance roles demand rigorous background checks. A qualified agency should verify professional licenses (ACA, ACCA, CPA, CFA), review regulatory standing, and confirm cross-border eligibility where relevant. This step is critical to mitigating compliance risks.

Our experience at DevsData LLC

We perform credential verification for all regulated roles, including ACA/ACCA/CPA/CFA status, regulatory standing, and jurisdiction-specific eligibility. For cross-border candidates, we confirm work authorization, professional equivalence, and licensing pathways upfront, reducing downstream compliance risk for clients.

London’s financial sector is globally connected, often requiring talent with cross-border experience. An ideal agency maintains international sourcing pipelines while also understanding the competitive dynamics of Canary Wharf, the City, and FinTech clusters. Balance of global reach with local market knowledge ensures faster, targeted results.

Our experience at DevsData LLC

We maintain active sourcing pipelines across the UK, EU, and select nearshore regions, combined with a 65000-person vetted talent pool. Our London team understands local market pressures, salary expectations, regulatory demands, and competition dynamics, while leveraging our global presence to accelerate time-to-fill.

Transparent terms matter. Success-fee models (payment only upon hire) with guarantee periods help align incentives and reduce client risk. Avoid agencies that lack clear commitments on candidate replacement or retention.

Our experience at DevsData LLC

We operate on a pure success-fee model with a guarantee period for every hire, ensuring clients pay only when value is delivered. Our replacement commitments, retention-oriented assessment processes, and reduced backfill rates have become a core part of our long-term relationships with London clients.

The best agencies go beyond recruitment, offering guidance on compensation benchmarking, organizational design, regulatory compliance (e.g., AML/KYC requirements), and talent strategy for growth scenarios such as IPO readiness or IFRS transitions.

Our experience at DevsData LLC

Alongside recruitment, we advise clients on compensation structures, finance-team design, regulatory competency requirements (FCA, PRA, AML), and readiness for transformations such as ERP migrations, IFRS adoption, BI upgrades, and audit remediation. This helps ensure teams are not only staffed but aligned to long-term strategic goals.

Website: www.devsdata.com

Company size: ~60 employees

Founding year: 2016

Headquarters: Brooklyn, NY, and London, UK

DevsData LLC is a trusted partner in specialized banking and finance recruitment, with a strong track record of placing Investment Bankers, Risk Managers, Compliance Officers, CFOs, Controllers, Treasury Specialists, and niche experts such as AML/KYC and SOX/ICFR professionals. Our structured, data-driven approach reduces time-to-hire, improves retention, and ensures placements strengthen governance, compliance, and long-term value creation.

We support institutions across London’s financial sector, from global banks and private equity firms to FinTechs and insurers. With a 65000+ vetted talent pool and a 60+ person team across the UK, EU, and US, we combine AI-powered sourcing, credential verification (ACA, ACCA, CPA, CFA), role-specific case studies, and structured interviews to deliver the right candidates quickly and reliably.

DevsData LLC operates under an official, government-approved recruitment license and works on a success-fee model, with a guarantee period for every hire. Our candidates are recognized for board-ready reporting, communication with non-finance stakeholders, and fluency with modern toolchains, from ERP (SAP, Oracle, NetSuite) and BI (Tableau, Power BI) to data/automation (Python/SQL).

With 100+ completed projects for 80+ global clients and top 5.0 ratings on Clutch and GoodFirms, we’ve helped organizations in London accelerate close cycles, strengthen risk controls, and build audit-ready reporting. In one of the world’s most competitive finance markets, we deliver precision, performance, and measurable outcomes in every engagement.

Recruiting traders and portfolio managers for a proprietary fund

A trading firm needed discretionary portfolio managers with verifiable profitability, disciplined risk frameworks, and the ability to deliver under pressure. The challenge was balancing proof of performance (track records, Sharpe ratios, trial portfolios) with behavioral traits like adaptability and communication. We designed a funnel with virtual trading trials, portfolio history reviews, and structured interviews that tested execution discipline and risk control. Within just over a month, four hires were made, exceeding the original target.

Key learning: in high-stakes trading roles, performance-based evaluations paired with structured behavioral interviews are the strongest predictors of sustainable success.

A London-based investment company operating in algorithmic trading and crypto exchange sought senior engineers with exceptional algorithmic and systems knowledge. The main difficulty was combining hard CS fundamentals with finance-specific awareness of trading environments. We used a rigorous process: qualification, timed programming challenges, live coding, and client-side trading system assignments. The client planned to hire one engineer but ultimately hired four and opened an engineering hub in Poland.

Key learning: for quant and trading environments, stress-tested evaluations under time pressure reveal which candidates can thrive in real-time, high-latency systems.

Kroll, a global leader in risk and compliance, required engineering capacity for backend and big-data projects tied to financial risk, compliance, and investigations. The challenge was hiring engineers who could work securely with sensitive data pipelines and build tools for compliance reporting and transaction monitoring. We delivered backend and visualization experts with strong domain alignment, ensuring secure, scalable systems.

Key learning: in compliance-sensitive financial contexts, sourcing engineers with proven data security and regulatory awareness ensures that technical delivery supports governance and audit needs.

Address:

DevsData London Tech Recruiters

35C Ormiston Grove,

W12 0JR London, UK

london@devsdata.com

For more information about DevsData LLC, contact them at general@devsdata.com or visit their website at www.devsdata.com.

Not sure if partnering with a specialized banking and finance recruitment agency is the right move? Take this quick self-assessment. Answer the questions below and count how many times you answer “Yes.”

Quiz questions

Hiring in banking and finance is not just about filling vacancies, it’s about securing professionals who safeguard risk controls, ensure compliance, and enable accurate, timely decision-making. From front-office trading and treasury to compliance, audit, and CFO leadership, these roles influence every aspect of the business, from capital markets reputation to investor trust. A single misaligned hire can create compliance gaps, delay audits, or weaken financial resilience.

In London, where competition for finance talent remains among the highest in Europe, organizations cannot rely on generic recruitment.

Precision requires structured, evidence-based processes that go beyond resumes, testing risk judgment, audit and compliance rigor, capital forecasting, ERP/BI fluency, and communication under regulatory scrutiny.

At DevsData LLC, we focus on what truly matters in banking and finance recruitment: validated technical and regulatory competence, problem-solving under real constraints, and long-term cultural fit. Our methodology blends AI-assisted sourcing, credential and licensure verification (ACA, ACCA, CPA, CFA, CMA), tailored case studies (treasury liquidity drills, compliance scenario walkthroughs, audit simulations), and structured interviews. With a vetted talent pool of 65000+ professionals and a track record across global finance hubs, we deliver hires who make an immediate impact while supporting long-term growth.

Whether you’re hiring a Treasury Specialist, a Compliance Officer, or building a full finance leadership team in London, partnering with DevsData LLC can provide precision, resilience, and measurable outcomes.

Learn more at www.devsdata.com or contact general@devsdata.com.

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)