Nearshoring is the practice of outsourcing business or IT operations to nearby countries with similar time zones and cultural compatibility. For US companies, this typically means relocating services to Latin American nations rather than distant offshore locations. Nearshoring allows for easier collaboration, faster turnaround times, and reduced costs, making it a strategic alternative to traditional offshoring.

The US companies can significantly reduce IT development costs by nearshoring to Latin America, with potential savings of up to 50% while maintaining high-quality standards. In fact, 87% of software development companies in the US now consider nearshoring as a key strategy for maintaining competitiveness and operational efficiency. As the nearshoring trend gains momentum, particularly in the tech industry, evaluating top destinations like Mexico and Colombia has become essential for business leaders aiming to optimize their technology investments.

The rise of nearshoring in Latin America is further evidenced by estimates suggesting that nearshoring could generate an additional US$78 billion in annual exports of goods and services across the region in the near and medium term. As a result, Latin American countries are emerging as key players in the global outsourcing landscape. Among them, Columbia and Mexico stand out as 2 of the most prominent destinations for nearshore technology outsourcing, offering a blend of skilled labor, favorable business environments, and strong connectivity to the US market.

This article provides a detailed comparison of Mexico and Colombia as nearshoring destinations, covering costs, talent availability, tax structures, innovation, and business conditions, helping companies make informed decisions when choosing where to build or scale their development teams.

When considering IT nearshoring to Latin America, Colombia and Mexico emerge as standout choices for US companies, offering numerous advantages over alternatives like Argentina or Chile. Their geographic proximity and time zone alignment are particularly compelling, simplifying collaboration and fostering effective communication.

Mexico spans 3 time zones that overlap with those in the US, while Colombia operates on GMT-5, just one hour behind Eastern Standard Time (EST). This synchronicity ensures seamless real-time interactions, a critical factor for businesses managing complex projects across borders. Moreover, both countries boast vibrant tech ecosystems supported by substantial venture capital investments, which have cultivated environments ripe for innovation.

Both countries also offer a sizable and growing tech workforce. Mexico produces over 130,000 engineering and technology graduates annually, while Colombia adds around 90,000 to its talent pipeline each year. This steady supply of skilled professionals ensures a robust talent pool for companies building long-term development teams. In addition, Mexico is home to more than 700,000 software developers, and Colombia hosts approximately 150,000, giving businesses access to mature tech communities with experience in web, cloud, and FinTech development. These figures support consistent hiring at scale without compromising quality.

Mexico and Colombia have emerged as pivotal nearshoring destinations in Latin America, each offering unique advantages for IT outsourcing. For both, nearshoring is a key driver of economic activity, and both feature stable business climates conducive to nearshoring success.

Mexico’s IT services market is expected to reach $18.86bn in 2025, with 5.39% projected annual growth through 2029. Colombia’s market is smaller, expected to reach $2.17bn in 2025, however it is growing faster at 6.29% annually. For companies looking to nearshore, this translates to deeper talent pools in Mexico but potentially better pricing in Colombia’s more competitive market.

For both nations, IT outsourcing contributes substantially to their economies, with the United States serving as the primary export partner.

Mexico and Colombia both stand out for the quality of their tech talent, recognized across Latin America for their expertise in cutting-edge technologies. Mexican software developers excel in data science, mobile security, Python, and FinTech. Their excellence in the latter is tied to the country’s robust FinTech development landscape, supported by regulations like Mexico’s FinTech Law. This has created a favorable environment for innovative FinTech solutions and advanced technologies, including data science and mobile development. Meanwhile, Colombian developers are celebrated for their proficiency in web development, cloud computing, and data analysis, alongside a strong JavaScript community of over 3000 members hosting regular meetups in 8 cities.

Both countries share a strong cultural affinity with the United States, ensuring smooth collaboration. English proficiency levels are comparable, with developers from both regions known for their openness and teamwork. However, slight differences in work culture exist: Mexican professionals are often described as assertive, while Colombian developers are lauded for their dedication and reliability.

Mexico takes a leadership position in innovation, particularly in FinTech, where it ranks 1st in Central America and supports 773 FinTech startups. Its vibrant startup ecosystem spans eCommerce, HealthTech, energy, and transportation, with twice as many unicorns as Colombia. Colombia, while trailing slightly behind, excels in transportation startups (422 to date) and shows strong performance in foodtech and environmental innovation. In Latin America’s Global Innovation Index rankings, Mexico secures the 3rd spot, while Colombia follows in 5th.

Both Mexico and Colombia are cost-effective compared to US rates. Hiring a Senior DevOps Engineer costs $85200 annually in Mexico and $67200 in Colombia, while the same expertise in Texas, US, for example, costs $2250600 —a 135-165% increase. For companies aiming to optimize budgets without sacrificing talent quality, these countries present a compelling case.

Do you have IT recruitment needs?

Tax structures in Mexico and Colombia directly affect hiring models, payroll obligations, and the potential for tax relief through R&D incentives—key factors for companies planning nearshore operations.

Mexico’s tax system offers advantages, particularly due to tax treaties with the US and Canada. These treaties minimize tax liabilities for foreign businesses, making cross-border transactions more favorable. Businesses hiring in Mexico can choose between 2 employment models:

Mexico also supports innovation with a 30% tax credit for R&D activities, encouraging tech companies to invest in research-focused projects.

Unlike Mexico, Colombia does not have a tax treaty with the US, which increases the risk of double taxation for foreign businesses. However, the country offsets this with robust R&D incentives. Businesses can claim a 25% tax discount and a 100% tax deduction for expenditures on tech, scientific research, and innovation. These provisions aim to attract tech companies despite the absence of favorable treaty benefits.

When evaluating nearshoring options, it’s essential to consider various risk factors that can impact business operations. Below is a comparative analysis of Mexico and Colombia across several critical areas.

Mexico has historically been a favorable destination for nearshoring, largely due to its political stability and strong trade agreements, such as the United States-Mexico-Canada Agreement (USMCA). The USMCA facilitates tariff-free or minimal-duty trade between Mexico, the US, and Canada, enhancing Mexico’s attractiveness for businesses seeking efficient supply chain integration.

Colombia has made significant strides in political stability and economic reforms, fostering a pro-foreign direct investment (FDI) environment. The government’s liberalization efforts established frameworks that treat foreign investors on par with national investors, lifting controls on profit remittance and capital flows.

In 2024, Mexico’s GDP growth slowed to 1.8% in the first half, down from 3.2% in 2023, indicating a moderation after the post-pandemic rebound. The International Monetary Fund projects a slight widening of the current account deficit in 2024, as investment and consumption-related imports outpace exports. Additionally, the Conference Board Leading Economic Index for Mexico decreased by 0.3% in October 2024, suggesting potential economic challenges ahead.

Colombia’s economy is projected to expand by 1.5% in 2024, with expectations to surpass the 2.9% potential growth rate in subsequent years. The OECD forecasts a GDP growth of 1.8% in 2024, reflecting the lingering impacts of tight macroeconomic policies and slowing global growth, with an acceleration to 2.8% expected in 2025. Notably, Colombia closed 2024 with an inflation rate of 5.20%, the lowest in four years, yet still above the Central Bank’s target of 3%.

Mexico is a member of several international agreements ensuring robust IP protections, including:

Mexico has modernized its IP laws, aligning with international best practices. The Mexican Institute of Industrial Property (IMPI) oversees patents, trademarks, and copyrights. Recent reforms, including better enforcement against counterfeiting and piracy, enhance business confidence. However, challenges like slow judicial processes and uneven enforcement persist.

Colombia’s IP framework is built around its commitments to agreements like:

The Superintendence of Industry and Commerce (SIC) is the primary authority for IP enforcement. Colombia has improved its enforcement mechanisms, particularly in combating software piracy and counterfeit goods. However, gaps in judicial capacity and delays in resolving disputes pose risks for businesses.

The country’s Free Trade Agreements, particularly with the US and the EU, reinforce its commitment to protecting foreign IP assets. For example, these agreements include provisions to safeguard patents and trade secrets.

In Mexico, the Federal Law on Protection of Personal Data Held by Private Parties establishes a comprehensive framework for safeguarding personal data. This legislation grants individuals rights to access, rectify, cancel, or object to the processing of their personal information. The National Institute of Transparency, Access to Information, and Personal Data Protection (INAI) serves as the regulatory authority overseeing compliance with these data protection standards.

In Colombia, data privacy is governed by Statutory Law 1266 of 2008, which regulates the processing of personal data, including financial and credit information. This law outlines fundamental principles for data processing and delineates the rights of data subjects, ensuring that individuals have control over their personal information. Additionally, companies operating in Colombia are required to have a data policy, appoint a data privacy officer, and register their databases with the National Database Registry (RNBD), reinforcing the country’s commitment to data protection.

Currency fluctuations are a critical factor for businesses considering nearshoring to Mexico or Colombia. The Mexican peso has demonstrated notable resilience among emerging market currencies. Since 2019, it has depreciated by only 4.4% against the US dollar, showcasing stability that is advantageous for financial planning and cost predictability.

Conversely, the Colombian peso has experienced more volatility. In recent months, it has been the weakest performer among emerging market currencies, depreciating by 5.87% against the US dollar. This fluctuation introduces additional considerations for companies in terms of pricing, contracts, and financial forecasting.

Before identifying which country is the better nearshoring choice, let’s line up the key differences between Mexico and Colombia.

Mexico and Colombia offer distinct advantages for nearshoring in Latin America, shaped by differences in market size, focus areas, and tax structures. Mexico boasts a significantly larger IT services market, with a revenue of approximately $25 billion, ranking as one of the largest in Latin America, while Colombia’s IT market, though smaller, valued slightly above $8 billion, is growing at a faster rate.

In terms of specialization, Mexico excels in FinTech, cloud services, and custom software development, supported by strategic partnerships with global tech firms. Colombia, on the other hand, leads business process outsourcing (BPO), bolstered by government incentives and innovative startups.

Tax systems also differ: Mexico offers benefits such as tax treaties with the US and Canada, making it attractive for foreign companies, but its payroll and social security contributions are relatively high. Colombia lacks tax treaties with the US, which can result in double taxation, but it provides generous tax incentives for innovation and R&D activities.

Geographically, Mexico’s proximity to the US makes it a natural nearshoring hub, while Colombia’s emerging tech ecosystem positions it as a growing competitor in South America. Together, these differences shape the unique nearshoring appeal of each country.

Do you have IT recruitment needs?

Establishing IT operations in Mexico and Colombia requires understanding specific timeframes, resource needs, and success factors. While both countries offer skilled workforces and cost advantages, there are unique challenges and opportunities in each. Below is an integrated guide to setting up operations in these regions.

Setting up a legal entity typically takes around 6 weeks in Mexico and 3-4 weeks in Colombia, depending on the documentation and local processing speed. Corporate bank accounts usually require 4-5 weeks in both countries, though stricter anti-money laundering procedures in Colombia can lead to delays. Factoring in hiring and infrastructure setup, companies can expect full operational readiness within 6-9 months in Mexico and six to twelve months in Colombia, depending on complexity.

To streamline operations, local legal and administrative support is crucial for managing labor, tax, and corporate regulations. For talent acquisition, both countries have a robust pool of IT professionals. However, engaging recruitment agencies and using regional job platforms significantly accelerates hiring. On the infrastructure side, reliable office space and strong internet connectivity are essential, with urban centers like Mexico City and Bogotá offering the best conditions.

Regulatory compliance is central to long-term success. Companies must navigate tax obligations and employment laws, with Colombia presenting extra layers such as data protection and anti-corruption regulations. Cultural integration also plays a vital role—business relationships in Mexico often rely on personal rapport, while in Colombia, clear and direct communication is valued. Lastly, implementing strong quality assurance protocols helps maintain service consistency.

Delays caused by bureaucratic inefficiencies—especially in Colombia—are frequent, so it’s important to build flexibility into your timeline. Misunderstandings around local business customs can also create friction within teams or with partners. Finally, insufficient upfront planning around regulatory and technical requirements often leads to project delays and higher costs.

Consider beginning with a small pilot to test the local environment and adjust as needed. Partnering with established firms can provide valuable insights and help mitigate early-stage risks. A gradual scale-up—starting in major IT cities such as Mexico City, Guadalajara, Bogotá, or Medellín—allows teams to build local experience before expanding further.

When deciding between Mexico and Colombia for nearshoring, the choice ultimately depends on the specific needs of your business, the skills required, and the long-term goals of the project. But before identifying which country fits your business needs better, let’s review all the differences in business environment we’ve covered before:

| Category | Mexico | Colombia |

|---|---|---|

| Geographic proximity | Shares a border with the US, covering 3 time zones that overlap with the US | GMT-5, just one hour behind Eastern Standard Time (EST) |

| Venture capital | $832M in venture funding (2023) | $260M in venture funding (2023) |

| IT market size | $18.86bn, with 5.39% projected annual growth through 2029 | $2.17bn, with 6.29% projected annual growth through 2029 |

| Tech talent | Strength in FinTech, Python, mobile development, and data science | Expertise in web development, cloud computing, data analysis, and JavaScript |

| Innovation leadership | Leads in FinTech (1st in Central America) and has more unicorns | Strong performance in transportation, FoodTech, and environmental innovation |

| Costs | Senior DevOps engineer is paid $85200 annually | Senior DevOps engineer is paid $67,200 annually |

| Tax landscape | Tax treaties with the US minimize tax liabilities. Innovation R&D tax credit: 30% | Offers R&D incentives, including a 25% discount and 100% deduction for tech research |

| Political stability | Strong, with trade agreements like USMCA enhancing stability | Increasing stability with a pro-foreign direct investment environment |

| Economic growth | 1.8% GDP growth in 2024, slower than in 2023 | 1.5% GDP growth in 2024, accelerating in 2025 |

| Intellectual property | Member of TRIPS, USMCA agreements, modernized IP laws | Committed to TRIPS and Andean Community agreements, improving enforcement |

| Data privacy | Federal Law on Protection of Personal Data | Statutory Law 1266 of 2008, with strong data privacy standards |

| Currency risk | Mexican peso has remained relatively stable (+4.4% depreciation since 2019) | Colombian Peso has shown volatility (-5.87% depreciation recently) |

| Key differences | Larger IT services market, excels in FinTech and cloud services | Smaller but faster-growing market, excels in AI, analytics, and BPO |

If your business is looking for a nearshoring partner with a robust IT services market and proximity to the US, Mexico is likely the better option. Mexico’s IT sector is far larger than Colombia’s, making it a prime candidate for companies seeking scalability and access to a large pool of tech talent. Furthermore, Mexico’s geographical location gives it a strong advantage for US-based companies looking to maintain close working hours with their teams. Mexico also stands out for its FinTech, cloud services, and custom software development expertise. The tax treaties with the US and Canada can also make it a favorable option for those seeking tax relief, especially when paired with relatively low labor costs compared to the US.

On the other hand, Colombia might be the more suitable choice if your focus is on business process outsourcing (BPO). Despite its smaller IT services market, Colombia is growing rapidly at a rate of 6.29% annually, which surpasses Mexico’s 5.39% growth. The country’s specialization in AI, data science, and digital transformation projects, supported by a thriving startup ecosystem, positions it well for companies seeking cutting-edge solutions.

Additionally, Colombia’s tax incentives for research and development (R&D) activities—such as a 25% tax discount for tech projects—make it an attractive choice for tech-focused companies. Furthermore, Colombia’s tech talent is known for being strong in AI and analytics, areas where Mexico does not yet have the same level of specialization.

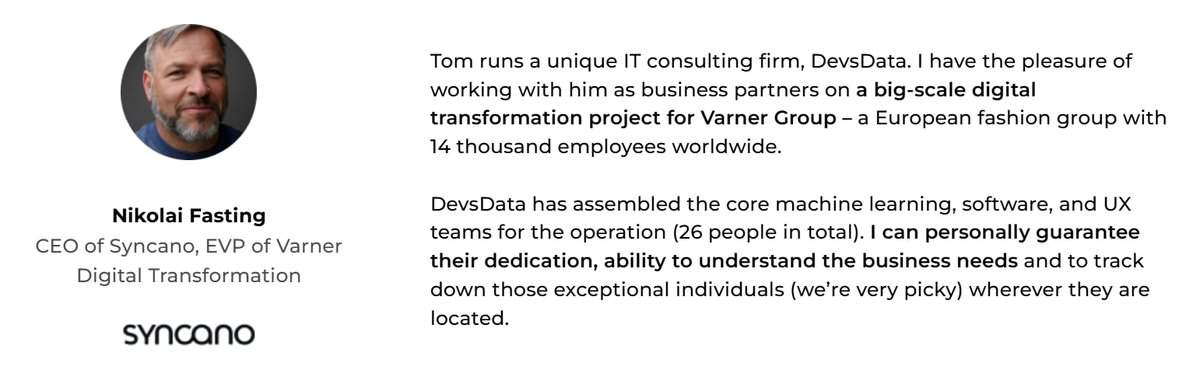

DevsData LLC is a reliable software development and IT recruitment agency with over 8 years of experience, specializing in providing tailored solutions for businesses exploring nearshoring options in Mexico and Colombia. DevsData LLC has offices in Mexico (Tijuana, Monterrey, and Guadalajara, among others) and Colombia (Bogotá, Medellin, and Cartagena, among others), providing clients with direct access to top engineering talent in these rapidly growing tech hubs.

With a strong local presence, the company offers in-depth market expertise, streamlined recruitment processes, and on-the-ground support, ensuring smooth collaboration and efficient project execution. With a global client base spanning Europe, North America, and Asia, the company has earned a reputation as a trusted partner for organizations aiming to streamline operations. DevsData LLC has maintained a 5/5 rating on platforms like Clutch and GoodFirms, reflecting its commitment to exceptional client satisfaction.

What sets DevsData LLC apart is its dual focus on custom software development and IT recruitment. The company excels in advanced fields such as artificial intelligence, machine learning, and data science, having completed over 100 projects that include scalable backend systems and dynamic web applications for industries such as healthcare, eCommerce, and finance. Its diverse client base includes well-known brands like Skycatch, Cubus, and Novartis.

In addition to its development expertise, DevsData LLC offers specialized IT recruitment solutions, addressing one of the key challenges in nearshoring—securing top talent. The recruitment process is led by senior engineers to ensure candidates meet high technical and soft-skill standards. For instance, in a recent collaboration with a financial services firm, DevsData LLC sourced exceptional talent, which resulted in the client hiring multiple developers and even setting up a new engineering office. This approach highlights DevsData LLC’s ability to find and place talent in Mexico and Colombia, as well as other global hubs.

By combining top-notch software development services with comprehensive recruitment solutions, DevsData LLC offers businesses a holistic approach to nearshoring to Mexico and Colombia. Its adaptability, technical expertise, and client-focused approach make it an ideal partner for organizations seeking to harness the advantages of nearshoring in these countries.

Do you have IT recruitment needs?

Contact DevsData LLC via email at general@devsdata.com or research their services more at www.devsdata.com.

Address:

DevsData IT Recruitment LatAm

Real Mayorazgo 130 Xoco, Benito

Juárez Ciudad de México 3330

latam@devsdata.com

When deciding between Mexico and Colombia for nearshoring, several key factors influence the choice. Mexico has a significantly larger IT services market, generating revenues that are 8 times higher than Colombia’s, but Colombia is experiencing faster growth in its IT sector. Both countries are strong nearshoring destinations for US firms, with Mexico leading in sectors like FinTech, eCommerce, and HealthTech, while Colombia excels in transportation, FoodTech, and energy. Both countries also share proximity to the US, a common language, and a similar cultural background, making them ideal for nearshoring software development.

Mexico boasts a larger talent pool, especially in fields such as data science, FinTech, and mobile development, while Colombia stands out for its expertise in web development, cloud computing, and data analysis. In terms of market size and innovation, Mexico is ahead, ranking higher in the Global Innovation Index, but Colombia is catching up with its rapidly growing startup scene and strong government incentives for R&D. While Mexico’s tax environment offers some relief, Colombia lacks such agreements, potentially leading to more complex tax situations.

For businesses seeking highly skilled talent and competitive costs, Mexico offers a more substantial talent pool and a broader IT services market. Colombia is a strong choice for firms focusing on specialized niches and requiring cost-effective options in transportation or FoodTech.

In this context, DevsData LLC emerges as a reliable partner. With offices in both Mexico and Colombia, the company provides specialized software development and IT recruitment services, ensuring top-tier talent placement and seamless nearshoring operations. Their dual expertise in cutting-edge technology and recruitment allows them to address both development and staffing needs effectively, making them a strong option for businesses exploring nearshoring to Mexico and Colombia.

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)