Mexico’s artificial intelligence sector is expanding steadily. The market reached approximately $2.8 billion in 2024 and is expected to grow to $3.68 billion in 2025. This upward trend reflects increasing demand across industries and growing investor confidence. Mexico’s growing AI market is particularly notable, considering its population of 132 million, which makes it one of the largest and most dynamic economies in Latin America. The country also ranked third in UNESCO’s AI Technology and Government Readiness Index, indicating strong potential for further development and regional leadership.

Given that AI is expected to contribute 3.5% to the global GDP in 2030, Mexico is attracting significant investments, particularly from US tech firms exploring nearshore software development. From healthcare to finance, AI is revolutionizing industries and driving innovation, positioning Mexico as a rising player in the global AI landscape.

In this article, we will explore the current state of Mexico’s AI industry, examining the key drivers behind its rapid growth and the emerging trends shaping its future. We will also look at the challenges the country faces in realizing its full AI potential.

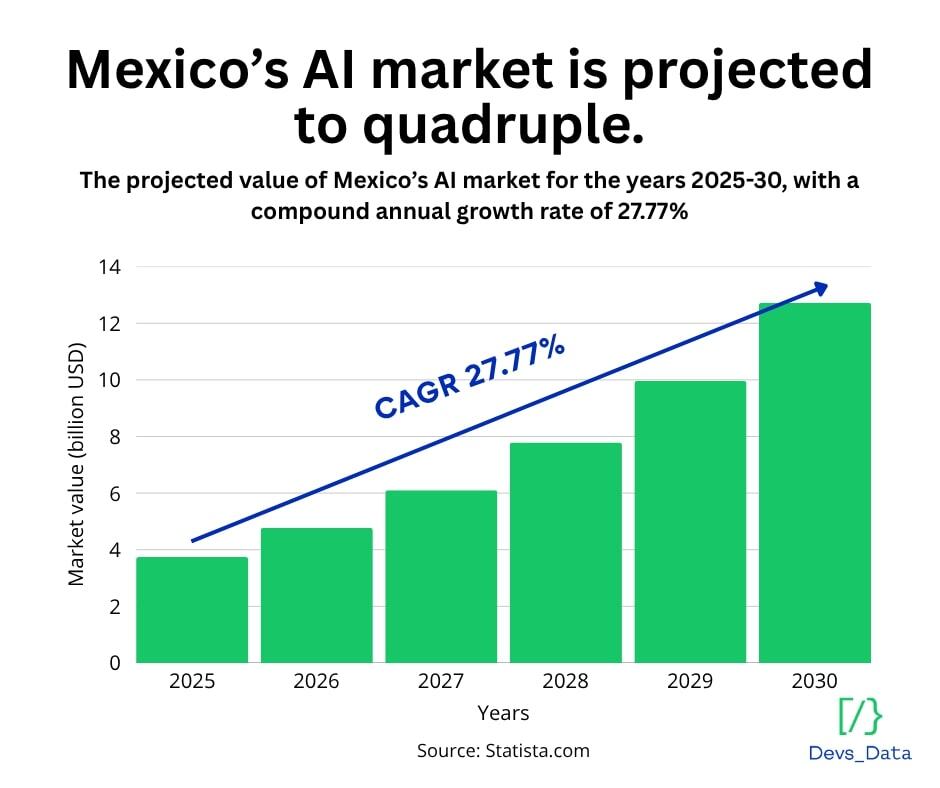

Mexico’s AI industry is becoming a significant economic driver. From 2025 to 2030, the industry is expected to grow at a compound annual growth rate (CAGR) of 27.77%, resulting in a market volume of $12.53 billion by 2030. The country’s AI sector is advancing in areas such as robotics, generative AI, natural language processing (NLP), machine learning (ML), and computer vision. Looking ahead, the generative AI market alone is projected to reach $13.9 billion by 2032, marking a continuous upward trajectory.

Mexico ranks 7th in Latin America for AI adoption, with numerous industries integrating AI into their operations. Key areas of adoption include IT process automation, security, business analytics, and monitoring. According to IDC, 81% of companies in Mexico have either implemented AI or plan to do so in the next 2 years, and almost half of them have already begun implementation.

Additionally, AI companies in Mexico have attracted approximately $640 million in investments in the past two years, driving an average revenue of $1.3 million per company in 2024. This investment helps fuel growth and innovation, positioning Mexico’s AI industry for sustained success in the years ahead.

Mexico’s AI scene includes well-known players such as Yalantis, 9Series Inc., Rocket Code, Icalia Labs, and Immediatum, which develop custom AI solutions, data analytics tools, and automation systems for various industries. The country is also home to 228 AI startups, such as Yana, Kolors, Pulsar, and Apli.

Among the industries leading this transformation are manufacturing, finance, and IT services. In manufacturing, AI is being utilized to optimize production lines, minimize downtime, and enhance safety standards. Financial institutions are leveraging AI for real-time fraud detection, risk modeling, and personalized customer experiences. At the same time, IT service providers are enhancing automation and analytics, enabling businesses to deploy AI more effectively across their operations.

Together, these sectors not only reflect where AI adoption is most advanced but also where the economic impact is likely to be most significant in the coming years.

One of the key drivers of AI growth in Mexico is the rapid expansion of the eCommerce sector, which is fueling demand for generative AI in customer communication. Businesses are increasingly turning to conversational AI tools integrated with WhatsApp to automate customer service, answer product inquiries, provide real-time order updates, and offer personalized recommendations. With over 77 million users in Mexico, WhatsApp has become a central channel for business-to-consumer interaction. Generative AI enhances these interactions by enabling companies to deploy AI-powered chatbots that can understand natural language, respond intelligently, and operate around the clock, improving both efficiency and customer satisfaction. As a result, the generative AI market in Mexico is projected to grow at a 36.98% CAGR in the coming years. By comparison, the United States remains the largest AI market, expected to reach $21.65 billion in 2025.

Building on this progress, the launch of G.A.I.L., the first generative AI laboratory in Mexico and Latin America, was a significant milestone for the country’s AI industry. Located in Guadalajara, the lab was created through a collaboration between Wizeline and Tecnológico de Monterrey. G.A.I.L. focuses on developing practical uses of generative AI, including tools for language processing, automation, and data handling. It also serves as a training ground for students and professionals, helping them gain hands-on experience with advanced software systems. By bringing together researchers and businesses, the lab supports the broader adoption of generative tools in areas such as healthcare, retail, and financial services. It strengthens local capabilities in this rapidly growing field.

The market for machine learning in Mexico is expected to reach $8 billion by 2030, driven by a 32.08% CAGR. Machine learning adoption is rapidly expanding across various industries, with the healthcare sector seeing particularly strong growth. As reported by 6WResearch, the surge in machine learning adoption is playing a key role in the healthcare sector’s rapid expansion. In Mexico, hospitals and healthtech startups are using machine learning to improve diagnostic accuracy, predict patient outcomes, and optimize treatment plans. For example, machine learning is being used to analyze medical imaging data to detect conditions such as cancer at earlier stages.

The robotics market in Mexico is projected to experience significant growth. Revenue is expected to reach $1.39 billion by 2029, driven by a CAGR of 13.69% from 2025 to 2029. Robotics increasingly relies on AI, particularly machine learning and computer vision, to enable industrial robots to operate with greater precision, adapt to variable conditions, and optimize workflows without constant human oversight. In Mexico’s manufacturing sector, this integration is enhancing automation, improving productivity, and reducing operational costs. Major manufacturers such as General Motors are leading the way, deploying AI-powered robots in assembly lines at plants in states like Coahuila and Guanajuato. These robots can perform tasks such as welding, material handling, and precision part assembly with higher accuracy and efficiency, helping to streamline production and maintain quality standards.

Mexico’s AI industry is experiencing a transformative phase, driven by pivotal trends such as reskilling, nearshoring, and governance. These factors are shaping the country’s AI landscape and laying the groundwork for its future potential.

Generative AI is revolutionizing industries, creating demand for specialized skills and innovative solutions. This shift highlights the urgency for businesses, educational institutions, and governments to prioritize reskilling initiatives. Ensuring that the workforce is prepared for the demands of an AI-powered economy is key to unlocking sustainable growth.

Nearshoring is also emerging as a strategic advantage for Mexico. With its proximity to the United States and a growing pool of skilled professionals, the country is positioning itself as a preferred destination for AI development and implementation.

In Mexico, AI governance, covering regulations, ethical guidelines, and government-led initiatives, is still evolving but plays a critical role in fostering an ecosystem that supports innovation while addressing ethical and legal concerns. However, there is room for more cohesive policies to bolster AI adoption and drive industry-wide transformation.

About 34% of Mexican companies are actively working to secure funding independently, a sign of the sector’s increasing maturity and the recognition of AI’s vast potential.

This self-sufficiency lays the groundwork for a more resilient AI ecosystem capable of thriving with reduced reliance on external capital.

Moreover, Mexico is positioning itself as not just an AI hub but also a future center for chip manufacturing. As AI technologies depend on advanced hardware, the country’s investments in semiconductor production will be pivotal in supporting its AI infrastructure. A key initiative is the Kutsari Project, a sector-wide strategic plan to strengthen semiconductor design, manufacturing, and R&D capabilities through partnerships with leading academic institutions. The project includes phased development of local wafer fabrication, packaging, and testing facilities through 2030 and beyond.

To attract foreign investment, the government is offering fiscal incentives modeled after the US CHIPS Act, prompting major companies such as Foxconn and Intel to expand production. Foxconn is building a large facility to produce chips for AI applications, including Nvidia’s AI-focused GB200 chips. These infrastructure projects are paired with workforce development programs that deliver specialized education and training, creating the skilled talent needed to sustain growth in this sector. Together, these efforts strengthen Mexico’s role in the global technology supply chain while creating economic opportunities and fostering international collaborations.

Do you have software development needs?

As the use of AI increases, Mexico is working to build a legal and ethical framework that supports innovation while addressing potential risks. The country faces ongoing challenges around AI’s role in election campaigns, surveillance, data privacy, and misinformation. At the same time, AI offers clear benefits in areas like healthcare, policy analysis, and public resource management. The key challenge is to find a balance between fostering innovation and protecting public interest.

Mexico took an early step in 2018 by launching a national AI strategy focused on governance, research, education, ethics, and data infrastructure. However, implementation has been slow, and regulatory enforcement remains limited. In 2023, the Mexican Senate established the National Alliance for AI, an initiative aimed at strengthening the country’s AI ecosystem. Its objectives include developing public policy guidelines, promoting democratic AI use, addressing cybersecurity, and encouraging socially responsible innovation.

From a business perspective, Mexico remains an attractive environment for AI investment. Its tax framework offers favorable conditions for technology startups, and local governments are increasingly offering incentives to promote AI-related R&D. Still, regulatory uncertainty can be a drawback for foreign companies entering the market, particularly when it comes to data compliance, intellectual property, and ethical use guidelines, which are still being defined. A more comprehensive and updated regulatory framework could help increase investor confidence and accelerate industry-wide adoption.

AI is also beginning to play a transformative role in Mexico’s public sector. State-run institutions like Pemex (oil and gas) and IMSS (public healthcare) are adopting AI tools to improve service delivery, cut costs, and support complex decision-making. In healthcare, AI is being used for diagnostics and resource optimization. In agriculture, AI supports precision farming practices, and in education, it is helping personalize learning experiences.

On the research front, Mexico ranks 6th globally in AI publications, reflecting a strong academic base. Universities and research centers are actively involved in machine learning, robotics, and natural language processing projects. This academic progress is contributing to Mexico’s position as a rising center of innovation in Latin America, creating a foundation for new technologies and future AI applications.

The future of AI in Mexico looks promising. Efforts in governance, research, education, and infrastructure are setting the stage for a strong and sustainable AI ecosystem. By focusing on workforce reskilling, regulatory frameworks, and fostering innovation, Mexico is well-positioned to lead in AI technology, driving growth while ensuring ethical and responsible AI use across industries.

Mexico benefits from a large, skilled talent pool, with approximately 700000 IT specialists, many of whom specialize in AI, data science, and related fields. The country is investing heavily in education and talent development to ensure a steady supply of skilled workers to meet the demands of the growing AI sector. Universities such as the National Autonomous University of Mexico (UNAM) and the Monterrey Institute of Technology (ITESM) are ranked highly in Latin America, producing a steady stream of graduates in AI, engineering, and technology fields.

Many professionals in Mexico work as independent contractors, providing businesses with flexibility and cost savings when accessing top talent. This structure allows companies to hire highly skilled professionals without the overhead costs associated with full-time employees.

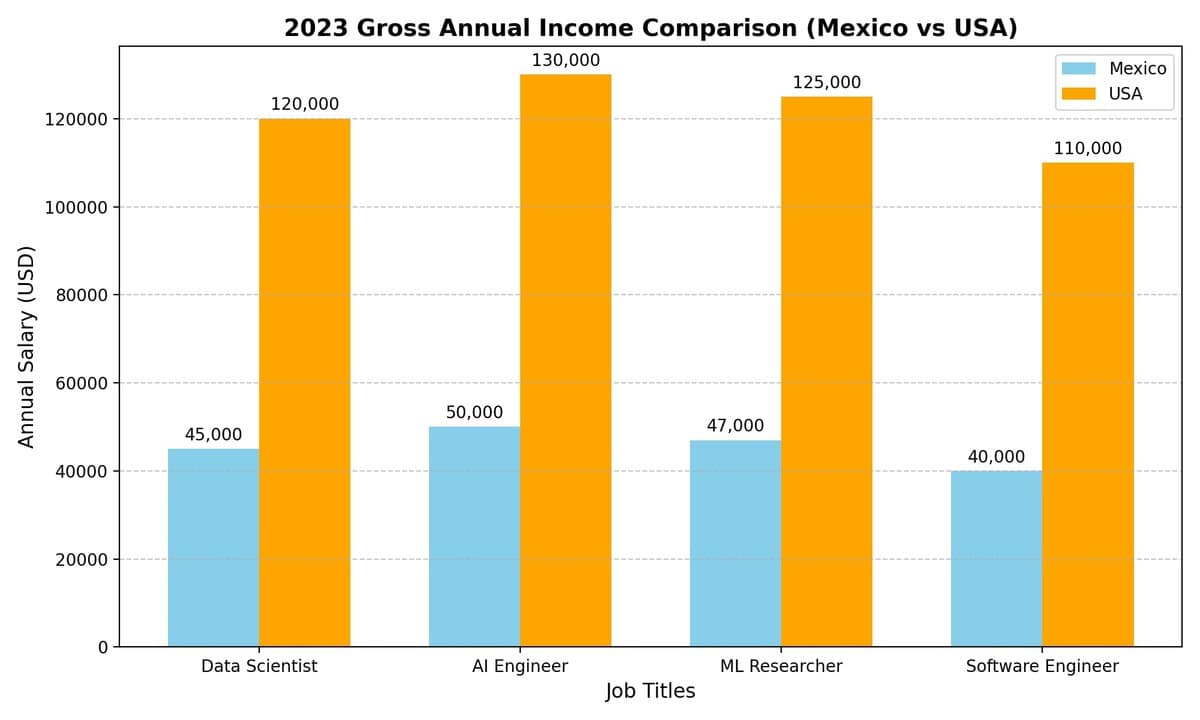

One of the key advantages driving Mexico’s AI growth is its cost-effectiveness. With lower operational costs compared to other countries, businesses can access high-quality AI talent and technology at a fraction of the price. This affordability makes Mexico an attractive destination for companies looking to implement AI solutions without the high overhead costs found in other regions. In addition to lower operational costs, the favorable currency exchange rate between Mexico and the United States adds to the cost savings.

Below, you can review a comparison of average salaries for tech roles between Mexico and the United States. For more detailed insights and references, visit platforms like Plane or Levels.fyi.

AI adoption in Mexico is expanding across key sectors such as healthcare, agriculture, and public services. In healthcare, institutions such as IMSS are applying machine learning to improve diagnostics and reduce wait times for patients. In agriculture, farmers are using technology to monitor soil conditions and manage water use more efficiently, which is especially important in regions facing drought. Public agencies are also utilizing data tools to enhance the delivery of services and the allocation of resources. These practical uses are helping organizations solve real problems and attracting more interest in the use of advanced technologies.

Despite a growing talent pool, there is a persistent shortage of highly specialized AI professionals. The rapid expansion of AI technologies has created a growing demand for experts in fields like machine learning and deep learning, but the supply of qualified professionals remains insufficient. Addressing this skill gap is critical to ensuring Mexico’s AI sector remains competitive and can continue to grow at a sustainable pace.

As AI technologies handle vast amounts of sensitive data, compliance with strict privacy and security standards becomes a pressing issue. Mexico faces challenges not only with its own data protection laws but also with international regulations such as the European GDPR, which apply when handling data related to EU citizens and can sometimes conflict with local practices. Establishing clear, standardized data governance frameworks that prioritize security and privacy will be essential to building public trust and supporting the responsible deployment of AI.

While AI adoption is advancing, many regions in Mexico still face limitations in digital infrastructure, including slow internet speeds, limited access to cloud services, and underdeveloped computing resources. These gaps can hinder AI implementation, particularly for small and mid-sized companies located outside major urban centers. Expanding access to reliable infrastructure is essential for the broader and more inclusive growth of AI across the country.

Do you have software development needs?

Making an international call to Mexico is a straightforward process.

Start by dialing the international access code for your country. For example, the code is 011 from the US, 00 from the UK, and 0011 from Australia.

Next, dial Mexico’s country code, which is 52. After that, enter the area code for the region you’re calling. Area codes in Mexico are typically 2 to 3 digits long, followed by a local phone number that is usually 7 to 8 digits. For instance, to call a local number in Mexico City from the US, you would dial 011-52-55, followed by the local number.

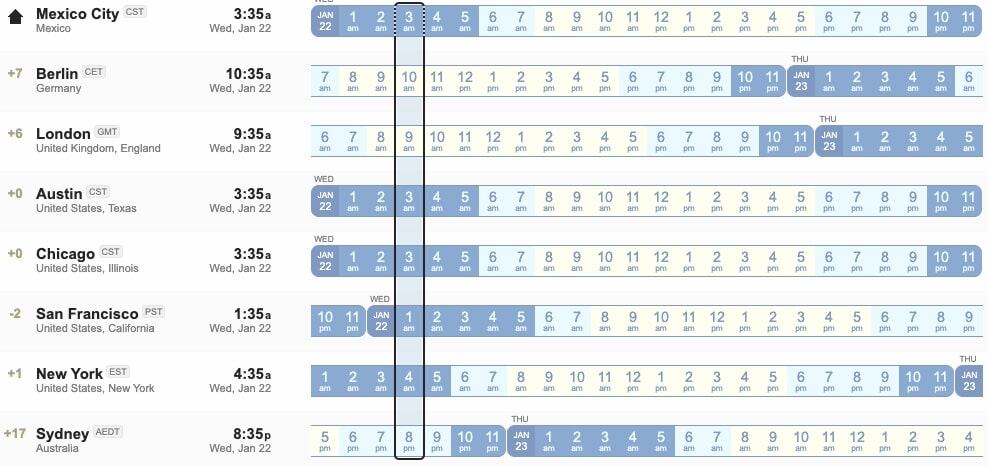

Since Mexico spans multiple time zones, including Central Standard Time (CST) and Mountain Standard Time (MST), it’s a good idea to check the time difference before calling to avoid reaching someone at an inconvenient hour.

In addition, international calls can be costly, so you can use a VoIP service like WhatsApp for more affordable rates.

Time zone awareness is crucial for effective communication and scheduling across different regions. Below is a comparison of the local times between Mexico City and several key cities worldwide:

| Destination | Time difference |

|---|---|

| Berlin, Germany | Mexico City is 7 hours behind |

| London, United Kingdom | Mexico City is 6 hours behind |

| Austin, TX | Mexico City is in the same time zone |

| Chicago, IL | Mexico City is in the same time zone |

| San Francisco, CA | Mexico City is 2 hours ahead |

| New York, NY | Mexico City is 1 hour behind |

| Sydney, Australia | Mexico City is 17 hours behind |

Mexico’s time zone makes it practical for working with teams in both North America and Europe. Hours match closely with cities like Austin and Chicago, while the time difference with London and Berlin remains reasonable for scheduled meetings. This allows teams to stay connected without shifting standard work routines.

Website: www.devsdata.com

Team size: ~60 employees

Founded: 2016

Headquarters: Brooklyn, NY, and Warsaw, Poland

While Mexico’s AI industry faces several challenges, these obstacles can be effectively addressed by partnering with the right organization. Choosing the right partner allows businesses to navigate legal complexities, bridge skill shortages, and access the necessary expertise to scale AI initiatives effectively.

DevsData LLC is a trusted outsourcing partner with a strong presence in Mexico, having established local offices in key locations across the country, including Querétaro, Tijuana, and Guadalajara. They offer customized software development services to meet clients’ unique needs.

With over 9 years of experience in the industry, the company has built a solid reputation as a reliable partner for businesses looking to outsource various software development requirements, specializing in AI, machine learning, and data science. By giving clients access to a global team of highly qualified engineers from the US and Europe, DevsData LLC helps bridge the skill gap in Mexico’s local market, providing immediate access to niche expertise that may be difficult to find locally.

Having successfully completed over 100 projects for more than 80 clients across industries such as IT, healthcare, and fashion, DevsData LLC is adept at managing complex, high-impact projects involving web development and complex backend systems. The company also supports clients in navigating data privacy and security challenges by implementing robust compliance practices aligned with international standards. Additionally, their distributed infrastructure and use of advanced cloud technologies help clients overcome local infrastructure constraints and scale projects more efficiently.

DevsData LLC’s strong partnerships with global corporations and fast-growing startups, particularly in the US and Israel, highlight their expertise in delivering scalable, high-performance solutions. With a 5/5 client satisfaction rate on Clutch and GoodFirms, they have earned recognition as a trusted partner in software development outsourcing. Their impressive client portfolio includes leading names such as Cubus, Skycatch, Varner, and Novartis.

In a recent project, DevsData LLC partnered with a client to develop a real-time human detection solution for a video stream on a low-cost, small device with an Nvidia GPU. Despite the hardware limitations, the team delivered a performance-optimized OpenCV-based algorithm that ran with low latency and high precision. By integrating C++ OpenCV with Python, they overcame the limitations of the official Python version and accessed CUDA algorithms for enhanced performance. The team is now extending the project to include real-time body part segmentation and gesture recognition for even more advanced predictions.

In addition to software development outsourcing, DevsData LLC provides IT recruitment services, offering businesses flexible solutions for creating and managing remote teams. With a government-approved recruitment license, the company has access to a vast network of over 65000 developers, allowing them to deliver personalized solutions that cater to their clients’ specific needs. Their comprehensive hiring process includes a 90-minute interview conducted by skilled professionals and technical assessments, ensuring that only the most qualified candidates with strong technical skills and excellent communication abilities are selected to join the teams.

Furthermore, as an Employer of Record (EoR) provider, DevsData LLC manages all aspects of employment for remote teams, such as contracts, payroll, benefits, and compliance with local regulations, allowing businesses to concentrate on their core operations. Their business process outsourcing (BPO) services also help companies streamline their operations by outsourcing non-essential functions like customer support, administrative duties, and more.

Do you have software development needs?

Address:

DevsData IT Recruitment LatAm

Parque Mariscal Sucre 9, Col. del Valle Centro

Benito Juárez, CDMX, 03103, Mexico

Mexico’s AI industry is rapidly evolving, with strong growth projected over the coming years. The country’s commitment to advancing AI technologies and its increasing adoption across various industries position it as a key player in the global AI landscape. With ongoing investments in research, infrastructure, and talent development, Mexico is establishing itself as a hub for innovation, attracting local and international companies. As AI continues to gain traction, Mexico’s contributions to the field are set to have a lasting impact on industries ranging from healthcare to eCommerce, further solidifying its role in the future of technology.

DevsData LLC is a trusted leader in software development outsourcing in Mexico, known for its exceptional team of google-level engineers and a proven track record of delivering high-quality, tailored solutions. Their skilled engineers and product managers, trained at leading European universities and with experience in prestigious tech companies and hedge funds, specialize in managing complex, large-scale projects and building initiatives from scratch. DevsData LLC ensures each project is executed with precision and attention to detail, consistently providing customized solutions that meet clients’ unique needs while driving efficiency and success.

Ready to see how outsourcing to Mexico can enhance your business efficiency while reducing costs? Reach out to DevsData LLC at general@devsdata.com or visit their website to discover how their customized solutions can support your business objectives.

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Build your project with our veteran developers

Build your project with our veteran developers

Explore the benefits of technology recruitment and tailor-made software

Explore the benefits of technology recruitment and tailor-made software

Learn how to source skilled and experienced software developers

Learn how to source skilled and experienced software developers

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)