Without strong accountancy and finance professionals, companies risk misreporting earnings, facing regulatory penalties, or misallocating capital, with consequences that can derail growth and erode stakeholder trust. Yet, recruiting top-tier talent in this field has evolved into a complex challenge. Relying only on credentials, such as certifications or years of experience, often fails to capture essential qualities like ethical judgment, cultural fit, and adaptability to emerging financial technologies. Traditional hiring frameworks frequently miss these deeper indicators, leading to mismatches that hinder performance and team cohesion.

The magnitude of the current talent squeeze is stark. In 2025, Deloitte reported that 85% of CFOs face a shortage of accountants or other finance talent. Moreover, the Talent Shortage Survey 2025 states that 76% of employers report difficulty filling roles due to a lack of skilled talent.

The combined effect of an aging workforce, technology-driven disruption, and a shrinking educational pipeline underscores how vital precision in hiring has become. Recent AICPA data shows a 6.6% decline in US accounting bachelor’s and master’s degree completions, highlighting growing pressure on the finance talent pipeline. A misaligned hire in finance can undermine internal control processes, hamper financial accuracy, and strain organizational trust.

At DevsData LLC, we specialize in sourcing and placing elite accountancy and finance professionals, balancing speed, quality, and cultural alignment. In this article, we’ll walk you through our proven recruitment methodology, offer real-world case examples, and deliver actionable advice to help you assemble finance teams that drive strategic clarity and long-term organizational growth.

While many roles can tolerate a learning curve, finance recruitment leaves little room for error. Candidates must meet licensing standards, master evolving reporting requirements, and prove they can safeguard financial integrity from day one. This creates unique challenges. Recruiters must look beyond résumés and distinguish between credential holders with genuine expertise and those without. They also need to identify professionals who can thrive in environments shaped by regulatory compliance and technological change. It spans roles from entry-level accountants and auditors to CFOs, controllers, tax advisors, and financial analysts. Unlike generic hiring, finance recruitment demands a nuanced understanding of regulatory frameworks, industry-specific reporting requirements, and the evolving skill set required to navigate digital transformation in finance.

At its core, accountancy and finance recruitment is about more than filling vacancies. It ensures that organizations secure individuals capable of maintaining accurate records, managing risk, forecasting growth, and aligning financial strategy with overall business objectives. This requires not only technical proficiency in areas such as IFRS/GAAP standards, taxation, and corporate finance, but also strong analytical, ethical, and communication skills. Specialized knowledge of certifications and standards is equally important, for example, IFRS (International Financial Reporting Standards), GAAP (Generally Accepted Accounting Principles), CPA (Certified Public Accountant), or ACCA (Association of Chartered Certified Accountants), as these qualifications define the technical requirements that finance professionals must meet.

Beyond technical skills, finance roles must actively partner with business teams and senior leadership. By translating financial data into actionable insights for the C-suite, finance professionals influence how companies allocate capital, manage risk, and execute growth strategies, making business acumen and stakeholder communication essential components of effective finance recruitment.

For companies, effective finance recruitment directly impacts stability and growth. A single mis-hire in a critical finance role can lead to compliance breaches, costly reporting errors, or misguided investment decisions.

Conversely, a well-aligned finance hire can strengthen governance, optimize performance, and enable leadership teams to make data-driven decisions with confidence.

Organizations across industries rely on a wide spectrum of finance and accounting professionals to safeguard compliance, manage risk, and drive business strategy. While needs differ depending on company size, sector, and stage of growth, some roles remain consistently in high demand:

| Role | Key responsibilities |

|---|---|

| Accountants (General and Chartered) | Ensure accurate financial reporting, manage ledgers, and maintain compliance with IFRS/GAAP standards. |

| Auditors (Internal and External) | Assess financial accuracy, identify risks, and strengthen internal controls for transparency and regulatory adherence. |

| Financial Analysts | Interpret data, create forecasts, and provide insights that guide investment, budgeting, and strategic planning. |

| Finance Business Partner | Analyze financial and operational performance and provide insights that inform executive decisions, resource allocation, and growth strategy. |

| Controllers and Finance Managers | Oversee accounting operations, budgeting, and reporting processes; ensure accuracy and timely delivery of financial information. |

| Chief Financial Officers (CFOs) | Shape financial strategy, manage investor relations, and align financial planning with organizational growth objectives. |

| Tax Specialists | Navigate complex taxation systems, optimize liabilities, and ensure compliance with evolving tax regulations. |

| Payroll and Compensation Specialists | Manage payroll cycles, employee benefits, and compliance with labor and social security laws. |

| Treasury and Risk Managers | Handle cash flow, capital allocation, and risk mitigation to maintain financial stability. |

These positions are critical to the operational and strategic health of any organization. Whether in a multinational enterprise or a growing SME, finance and accounting professionals serve as the guardians of accuracy, accountability, and long-term business sustainability.

Do you have recruitment needs?

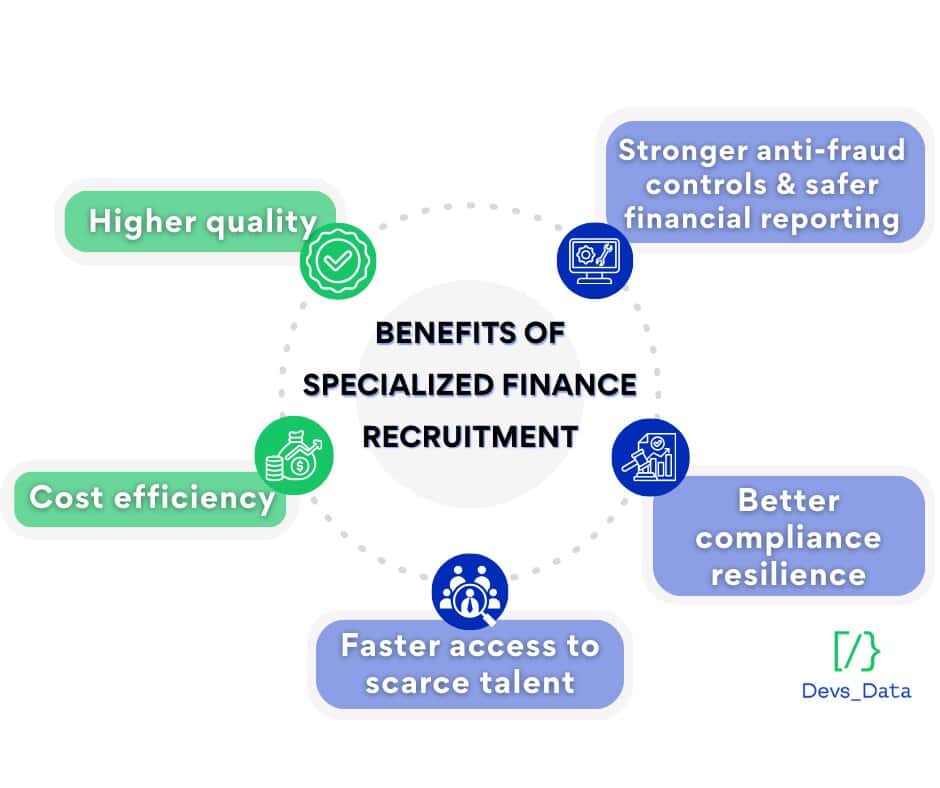

Finance hiring is high-stakes: mis-hires can undermine controls, delay reporting, and expose organizations to regulatory and financial risk. Specialized finance recruitment mitigates these risks by combining role-specific assessment, regulatory expertise, and targeted global sourcing. The following benefits highlight how this approach strengthens hiring outcomes across quality, compliance, speed, and cost.

Specialized recruiters design role-specific screens (e.g., IFRS/GAAP case tasks, audit scenario walkthroughs, treasury cash-risk exercises) and pair them with validated assessments. Evidence shows this raises hiring quality: in 2024, 78% of HR professionals said pre-employment assessments improved the quality of their hires.

Finance hires with deep controls, audit, and ethics experience measurably reduce fraud exposure. The ACFE’s 2024 global study (1,921 cases across 138 countries) found more than half of occupational frauds stem from a lack of internal controls (32%) or override of controls (19%), while 43% of cases were detected via tips, underscoring the value of professionals who implement controls and whistleblowing mechanisms.

When regulators intensify scrutiny, specialized finance recruitment helps secure talent with SEC reporting, SOX, AML, and internal-control expertise. In 2024, the US Securities and Exchange Commission (SEC) filed 583 enforcement actions and obtained a historic $8.2 billion in financial remedies, underscoring vigorous regulatory oversight across reporting, disclosure, and market conduct. Recruiting seasoned compliance and reporting leaders mitigates the risk of misstatements and penalties.

Specialized finance recruitment agencies shorten time-to-hire by leveraging established cross-border talent pipelines, including CPA- and ACCA-qualified professionals and finance shared-services hubs. This global reach allows companies to access pre-vetted, role-ready candidates even when local markets are saturated, reducing prolonged vacancies in critical finance roles. The importance of this advantage is evident in current market behavior: in 2025, Reuters reported that US. accounting firms are expanding hiring operations in India in response to an estimated 10% decline in the domestic accountant workforce between 2019 and 2024. Organizations that partner with recruiters experienced in global finance sourcing gain a structural speed advantage in constrained talent markets.

Precision hiring reduces backfills and downstream costs (onboarding, remediation, re-recruiting). As a baseline, SHRM benchmarking pegs the average cost per new hire at $4683 (Q4 2024); avoiding even a single failed hire in a critical finance role prevents duplicated spend and disruption. Specialized processes (structured interviews, work samples, reference calibration) help get it right the first time.

Many of the risks in finance hiring stem from structural changes in the talent market rather than individual candidate gaps. Declining graduate pipelines, evolving credentialing rules, heightened audit scrutiny, and rapid technology adoption have reshaped what “qualified” truly means in finance roles. The challenges below highlight where conventional hiring breaks down and how a specialized recruitment approach helps organizations maintain quality, compliance, and continuity.

Openings remain high in finance-heavy sectors. The US Bureau of Labor Statistics’ July 2025 JOLTS release shows ~311000 job openings in finance and insurance, reflecting sustained competition for qualified talent.

We run parallel searches across multiple geographies, maintain live shortlists of pre-vetted candidates (FP&A, audit, tax, treasury), and use proactive “evergreen” sourcing for roles with predictable churn. For example, in our BNP Paribas case study, we delivered seven senior engineering hires in just over four weeks, balancing speed with enterprise-grade compliance requirements.

Credentialing requirements across finance and accounting are evolving unevenly, increasing compliance and mobility complexity for employers. In the US, CPA pathways are changing, with nearly 20 states revising or reconsidering the 150-hour licensing requirement to rebalance formal education and practical experience in response to workforce shortages. At the same time, regulatory expectations continue to differ across jurisdictions and role types, spanning accounting standards (US GAAP vs. IFRS), audit oversight regimes, tax and payroll rules, AML frameworks, and financial reporting obligations. For employers operating across states or countries, this patchwork creates ambiguity around candidate eligibility, license portability, and readiness to operate in regulated environments, raising the risk of delayed hires or compliance gaps if not carefully managed.

We map candidate eligibility by jurisdiction, verify licensing status and reciprocity up-front, and present hiring managers with a clear “licensure roadmap” (what’s valid now, what’s pending, and timelines to full licensure).

Regulators continue to flag issues in audit execution. The PCAOB’s 2024 inspection cycle still found 39% Part I. Deficiency rates across all inspected firms (down from 46% in 2023), underscoring the need for talent experienced in controls, documentation, and standards application.

We prioritize candidates with demonstrable audit quality indicators, PCAOB/ISA file experience, remediation leadership, and control testing depth, and use simulation exercises to test documentation rigor and reviewer-note resolution. In our Maersk Tankers case study, embedding audit-ready experts was key to strengthening governance and controls in high-risk workflows.

Finance tasks are being re-tooled by AI. The Financial Times reported in 2025 that hedge funds and finance teams now automate large portions of analyst workflows (e.g., DCF modeling, research synthesis), changing skill requirements toward oversight, judgment, and stakeholder communication.

Our role definitions and scorecards test technology fluency across the entire finance workflow, including ERP and BI systems, Python/SQL where relevant, and the ability to design, govern, and audit AI-enabled agents and processes. We assess not only output review, but also input design, workflow ownership, and control integrity. We segment searches for modern finance profiles (FP&A + data/automation) to future-proof finance teams.

Do you have recruitment needs?

Website: www.devsdata.com

Company size: ~60 employees

Founding year: 2016

Headquarters: Brooklyn, NY, and Warsaw, Poland

DevsData LLC is a trusted partner in specialized accountancy and finance recruitment, with a proven track record of placing Controllers, CFOs, Finance Managers, and FP&A leaders. Our structured, data-driven process combines role-tailored case studies, credential/licensure verification, and behavioral interviews to cut time-to-hire, raise retention, and deliver finance professionals who strengthen governance, ensure compliance, and create measurable long-term business value.

We support technology-driven and data-centric organizations across FinTech, healthcare, eCommerce, manufacturing, private equity/portfolio companies, and Enterprise SaaS. Our work encompasses the design and build-out of finance functions from inception, as well as the systematic strengthening of finance leadership and management layers to support organizational scaling, IPO and SEC reporting readiness, IFRS transitions, and enterprise-wide ERP implementations. Backed by a proprietary pool of 65000+ vetted professionals and a 60+ person team across the US and Europe, we combine AI-powered sourcing, credential and licensure verification (CPA, ACCA, ACA, CMA, CIA, CFA), role-tailored case studies (e.g., month-end close simulations, consolidation/variance analysis, audit/controls walkthroughs), and structured behavioral interviews to deliver the right candidates quickly and reliably.

DevsData LLC serves global enterprises and high-growth startups in markets including the United States, EU, and Israel. We operate under an official, government-approved recruitment license and work on a success-fee model (payment only upon hire), with a guarantee period on every placement.

Our finance candidates are consistently noted for their communication with non-finance stakeholders, board-ready reporting, and fluency with modern toolchains, from ERP (SAP, Oracle, NetSuite) and BI (Power BI, Tableau, Looker) to data/automation (Alteryx, Python/SQL). In addition, DevsData LLC can support clients with legal and tax advisory, HR advisory (employment law), and BPO services, enabling you to address compliance and operational needs that come with scaling finance teams globally.

We apply a performance-driven methodology that blends deep domain expertise with data-backed evaluation. Every candidate completes in-depth 90-minute technical and behavioral interviews, and our acceptance rate remains under 6%, ensuring each placement is vetted for technical proficiency, problem-solving ability, and cultural fit.

Our portfolio spans 100+ completed projects for 80+ global clients, with 5.0 ratings on platforms like Clutch and GoodFirms. We’ve helped organizations accelerate close cycles, strengthen internal controls, improve forecast accuracy, migrate ERPs, and stand up audit-ready reporting, consistently delivering precision, performance, and measurable outcomes in accountancy and finance recruitment.

A private investment firm, NewCoast Group, needed a senior backend engineer with deep Python/data-engineering skills to support live trading systems, delivered within one month. The challenge was marrying hard CS fundamentals (algorithms, distributed systems, Kubernetes) with hands-on knowledge of market data and trading workflows. We ran a multi-stage process (role calibration, targeted headhunting across CEE, technical vetting with trading-context tasks) and secured the candidate ahead of the agreed timeline.

Key learning: for quant/trading environments, calibrating assessments to real-time data ingestion and latency constraints sharply reduces false positives and time-to-hire.

BNP Paribas required multiple senior Java engineers who could operate in regulated, high-availability environments, seven hires in just over four weeks, including a tech lead. The difficulty lay in balancing speed with strict standards around architecture, reliability, and compliance. We assembled a cross-functional recruiting pod, activated our 65k+ vetted pool, and used architecture-level interviews and finance-specific case challenges to ensure fit.

Key learning: in large, regulated institutions, a dual track of rapid sourcing plus enterprise-context technical screens (microservices, transaction pipelines, HA patterns) enables scale without lowering the bar.

A London-based investment fund doing crypto algorithmic trading initially planned to hire one engineer but, after our rigorous funnel (timed algorithmics, live coding on real-time systems, and client-side trading tasks), expanded to four hires and opened an engineering branch in Poland. The core challenge was proving deep problem-solving under pressure and real-time data processing competence.

Key learning: for systematic/quant teams, pressure-tested evaluations (timed algorithmics + trading-system exercises) are the most reliable predictors of on-desk performance.

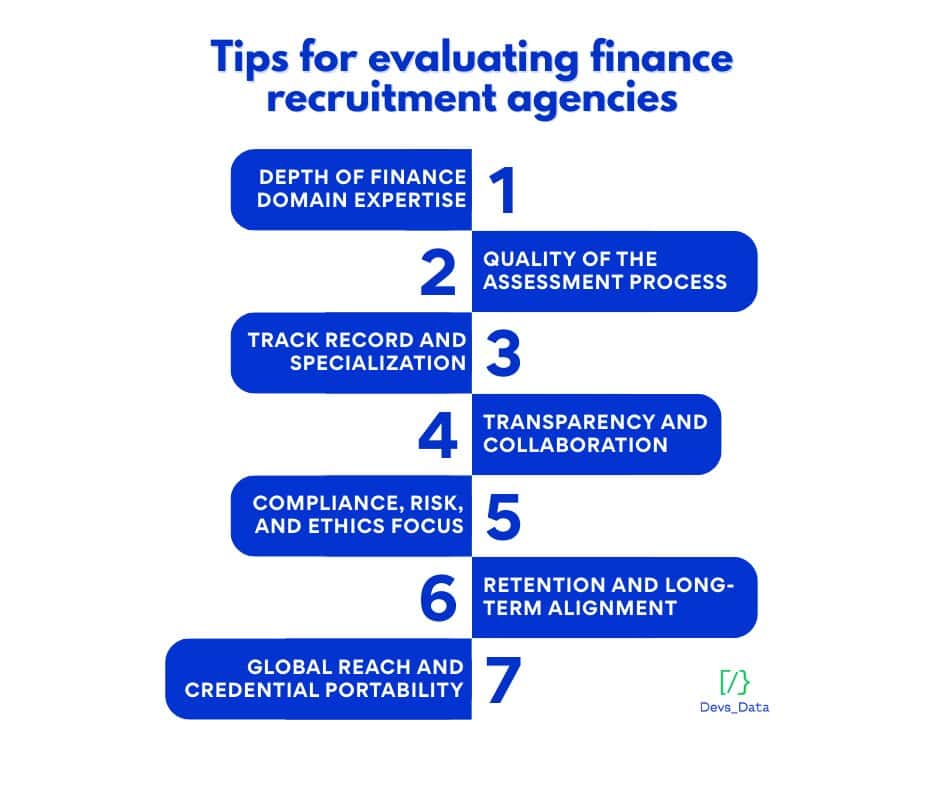

Choosing the right partner in finance recruitment can determine whether your controls strengthen and forecasts improve, or month-end closes keep slipping. Use these criteria when assessing potential agencies:

A strong finance recruiter should distinguish between Controllers vs. Finance Managers vs. FP&A, and understand nuances like multi-entity consolidation, IFRS vs. US GAAP, SOX/ICFR, SEC reporting, audit remediation, tax (direct/indirect), treasury/FX, and payroll compliance. Ask how they assess variance analysis, close acceleration, or audit-readiness, not just generic “Excel skills.”

Look closely at how candidates are evaluated. Do they run role-specific work samples (e.g., month-end close simulations, three-statement modeling, revenue recognition scenarios, audit/controls walkthroughs, tax exposure cases)? Do they verify credentials/licensure (CPA/ACCA/ACA/CMA/CIA/CFA) and probe stakeholder communication with non-finance teams?

Seek case studies in your context: IPO/SEC readiness, IFRS conversions, ERP transitions (SAP/Oracle/NetSuite), carve-outs, or shared-service builds. Specialized agencies often maintain proprietary pools of vetted finance talent and reusable frameworks for screening, which shortens time-to-hire while improving quality.

Effective recruitment partnerships are built on transparency and close collaboration. Clear pipelines, calibrated assessments, actionable market insights, and the ability to adapt searches as strategic priorities change are essential to delivering consistent hiring outcomes.

Finance hires sit close to controls and sensitive data. Ask how the agency handles background checks, conflicts of interest, and confidentiality, and how they evaluate candidates’ ethics and control mindset (e.g., documentation rigor, evidence trails, segregation of duties).

Hiring is step one; retaining finance leaders through fiscal cycles is where value compounds. Ask for retention metrics, guarantee terms, and how cultural fit, communication style, and change-management capacity are measured, especially during ERP rollouts or reorganizations.

If you hire across borders, confirm the agency’s experience with cross-jurisdictional payroll, tax, and credential equivalence (e.g., CPA vs. ACCA), and how they validate eligibility and mobility before you invest interview time.

Not sure whether a specialized finance recruitment partner is right for you? Take this quick self-assessment. Answer the questions below and count how many times you answer “Yes.”

Do you have recruitment needs?

Hiring for finance and accounting isn’t simply about filling headcount, it’s about securing professionals who can safeguard controls, accelerate close cycles, improve forecast accuracy, and uphold compliance under scrutiny. These roles touch every part of the business, from board reporting and investor relations to operational decision-making and regulatory filings. One misaligned hire can delay audits, introduce control gaps, or distort performance metrics.

As demand for skilled finance talent rises, organizations need structured, evidence-based recruitment that goes far beyond résumés or generic interviews. Effective finance hiring tests real capability, revenue recognition and consolidation scenarios, cash-flow modeling, audit/ICFR rigor, ERP/BI fluency, alongside stakeholder communication, ethical judgment, and cultural fit.

DevsData LLC supports enterprises and high-growth companies by prioritizing validated finance expertise, performance under real-world constraints, and long-term alignment with business and governance needs. Our approach blends AI-assisted sourcing that surfaces passive finance talent through skill signals, credential/licensure verification (CPA/ACCA/ACA/CMA/CIA/CFA), role-specific case tasks (close/forecast/audit/treasury simulations), and structured behavioral interviews. This methodology streamlines hiring without compromising rigor, consistently surfacing professionals who deliver measurable impact from day one and grow with your finance organization.

Whether you’re hiring a single Controller, adding a Treasury or Tax Specialist, or building a complete finance function for scale or IPO readiness, partnering with a specialized firm like DevsData LLC ensures your team is built on the right talent, delivered on time and aligned with your strategic goals.

Learn more at www.devsdata.com or contact general@devsdata.com.

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)