The hiring gap in technology continues to widen. Roles such as software engineers, data scientists, and cybersecurity specialists remain among the hardest to fill because they require rare combinations of technical expertise, practical experience, and problem-solving skills that are in short supply. According to the US Bureau of Labor Statistics, employment in computer and IT occupations is expected to grow by 14.6% between 2021 and 2031.

This talent crunch is forcing companies to compete fiercely for a limited pool of specialized professionals. Traditional methods often fail because job boards attract mostly active applicants rather than the highly skilled passive talent companies need. Referrals rarely scale beyond a handful of candidates, and in-house teams lack the global networks or technical expertise to assess niche roles.

As a result, many organizations turn to technology recruitment and IT staffing partners to bridge the gap. Rather than simply forwarding résumés, these firms bring market intelligence, access to global talent pools, and role-specific screening frameworks that focus on measurable hiring outcomes. In general recruiting, the average time-to-hire for technical roles can range around 30-45 days, and time-to-fill often sits near 40-60+ days due to sourcing and coordination delays, especially for niche positions like engineers and data scientists.

Recruiters who leverage proactive pipelines and targeted sourcing strategies, including reaching passive candidates, can shorten these timelines significantly compared with traditional, reactive channels where open roles linger without qualified applicants. Staffing partners also help improve quality-of-hire by focusing early vetting on skill-based assessments and interview-to-hire ratios, reducing the risk of mis-hires that typically increase cost per hire and new-hire attrition.

Beyond the competition for talent, the stakes are exceptionally high. Without skilled engineers, data experts, or security professionals, product launches stall, digital transformation slows, and organizations expose themselves to costly risks such as cyberattacks or compliance failures. In other words, fulfilling these roles is about safeguarding operations, maintaining competitiveness, and ensuring long-term resilience in a technology-driven economy.

Technology recruitment goes far beyond general hiring. While most recruiters can evaluate résumés and soft skills, tech recruiting requires the ability to judge complex technical proficiency, keep up with fast-evolving frameworks, and distinguish between candidates who can code on paper versus those who can deliver in production. The challenge is compounded by the fact that top engineers and data scientists are often passive candidates who aren’t actively applying for jobs, making them harder to reach. This is why global players like Google and Microsoft build dedicated tech recruitment functions – without specialized expertise, projects stall, deadlines slip, and innovation slows.

IT staffing, on the other hand, refers to the services companies use to bring this recruitment expertise into their organizations. Staffing firms provide access to vetted IT professionals through different engagement models.

A company might bring in temporary contractors to cover a short-term project, hire developers on a “temp-to-perm” basis to test fit before committing long-term, or secure direct-hire placements for permanent roles. For businesses with shifting workloads or urgent deadlines, this flexibility makes staffing indispensable.

The two concepts are closely linked. Technology recruitment is the overall discipline of finding and qualifying talent, while IT staffing is one way companies put it into practice. In essence, recruitment is the strategy; staffing is a delivery model. Other delivery approaches include direct hire placements, executive search for leadership roles, and RPO (Recruitment Process Outsourcing), where an external partner takes over part or all of a company’s hiring operations. Together, these models give businesses the flexibility to cover urgent gaps, test candidates before making long-term commitments, or build sustainable, permanent teams.

Do you have IT recruitment needs?

Technology recruitment has become one of the fastest-growing areas of the hiring industry. In 2024, the IT recruitment market was valued at around USD 185 billion, and by 2033, it is expected to almost double to USD 359 billion (CAGR 7.7%). This expansion highlights the essential role of software engineers, data scientists, cybersecurity specialists, and cloud architects across industries.

Behind the growth numbers lies a structural issue: demand is rising much faster than supply. A global talent shortage could reach 85 million people by 2030, with technology roles hit the hardest. For employers, this means higher salary pressure, longer hiring cycles for critical roles, and increased competition for already-employed talent. Companies now compete not only within their local markets but also across borders. In 2024, India and China recorded double-digit growth in IT recruitment and contract placements, reflecting both increased job orders and their expanding role as global talent suppliers. Global hiring works best for scarce, highly specialized roles, but is less suitable where on-site presence or local regulatory knowledge is essential.

For businesses, this mix of fierce competition and volatile cycles introduces real risk. Job boards and slow in-house pipelines are no longer enough. Companies need recruitment partners with global reach, speed, and access to both active and passive candidates in critical niches like AI, cybersecurity, and cloud engineering.

This is where DevsData LLC is positioned. With a network of 65000+ pre-vetted engineers across the US, Europe, and Latin America, and a rigorous process that accepts fewer than 6% of applicants, DevsData LLC delivers resilience. While traditional recruiters may be slowed by market swings, DevsData LLC’s selective, global model enables clients to secure top talent in under ten days.

AI and ML engineers

As of 2025, AI and machine learning engineers rank among the fastest-growing roles worldwide, reflecting the acceleration of digital transformation and adoption of generative AI. These roles are difficult to fill because they demand both mastery of algorithms and frameworks like TensorFlow or PyTorch, and the practical experience of deploying solutions in production environments – a rare combination.

Data engineers and data scientists

Businesses across industries rely on robust data pipelines and advanced analytics to remain competitive, driving strong demand for data engineers and data scientists. Building and maintaining these systems requires scarce expertise in ETL processes, big data platforms, and real-time processing. According to the 2025 Robert Half survey, data engineering roles ranked among the top tier of global hiring priorities, underscoring their importance.

Cybersecurity specialists and network security engineers

With rising cyber threats, stricter regulations, and the rapid expansion of cloud-based systems, cybersecurity specialists and network security engineers remain indispensable. The cost of falling short is measurable: the average global data breach cost reached USD 4.45 million in 2023, according to IBM Security research. At the same time, regulatory penalties have increased, with GDPR fines in Europe reaching tens of millions of euros per incident in severe cases. As a result, organizations must secure professionals who can both defend against evolving attack vectors and manage complex compliance obligations, making this skill set highly specialized and increasingly difficult to source.

In all of these cases, the challenge lies in the scarcity of cross-disciplinary expertise, competition for passive candidates, and demand outpacing supply. Skilled professionals are frequently already employed, meaning companies must rely on proactive outreach and rigorous vetting to secure them. This is precisely where specialized recruitment partners like DevsData LLC provide value: by maintaining a pre-vetted global network, applying multi-stage technical assessments, and engaging with passive talent, they enable clients to fill even the most competitive roles faster and with less risk.

Do you have IT recruitment needs?

Technology recruitment and IT staffing are most valuable when companies face moments of rapid change or specialized demand. Startups often rely on external recruiters because they need to scale quickly but lack the in-house resources to manage technical hiring at speed. A young AI firm in London or New York, for example, may need to assemble a dozen engineers in a matter of weeks – something a small HR team cannot achieve alone. In these cases, recruitment partners provide not only access to talent but also the structure and credibility to convince top candidates to join.

Mid-sized companies often utilize technology recruitment when expanding into new regions. Opening a branch in Berlin or São Paulo requires more than job ads; it takes local knowledge of salary benchmarks, compliance requirements, and available talent pools. Partnering with specialized agencies shortens that learning curve and secures critical hires before competitors make their move. Enterprises, meanwhile, often turn to IT staffing to cover niche or high-stakes positions such as cloud architects, blockchain engineers, or cybersecurity experts. These are not roles that attract applicants through traditional postings. They demand targeted sourcing, background checks, and rigorous technical assessment.

The way recruitment is used reflects this diversity of needs. In practical terms, it enables companies to meet clear objectives, such as hiring 3-5 senior engineers within 30-45 days to support a product launch or expansion milestone, while keeping operations secure and delivery on track. Recruiters manage the full cycle, from sourcing and screening to interviews and offer negotiations. In many cases, success depends on reaching passive candidates who are not actively applying but are open to the right opportunity. Access to these hidden talent pools often determines whether a company makes a timely, high-impact hire or settles for a slower, average outcome.

At DevsData LLC, this approach has been refined into a selective, multi-stage process. Candidates begin with a CV screening and optional problem-solving tasks before moving on to behavioral interviews that test communication and cultural fit. The centerpiece is a 90-minute technical interview led by senior engineers with more than ten years of experience, followed by final discussions with both our technical and business teams. Out of thousands of applicants, fewer than 6% are approved. Nearly half of all placements are finalized within ten days, and most are completed within two weeks. This combination of selectivity and speed helps lower early attrition and reduces the likelihood of failed hires or replacement cycles.

This level of speed and rigor makes technology recruitment not just a hiring function but a strategic tool. Whether it is helping a startup scale, guiding a mid-sized company through global expansion, or supporting an enterprise with specialized expertise, the outcome is the same: critical roles filled by professionals who are equipped to deliver lasting value.

With the global shortage of skilled engineers, companies often face months-long delays when trying to secure talent. Niche roles such as senior Java developers, cloud engineers, or data scientists are scarce even in large markets. At DevsData LLC, we specialize in accelerating these searches by combining targeted sourcing with rigorous multi-stage technical interviews, reducing time-to-hire without compromising quality.

For example, when BNP Paribas’s internal hiring teams had struggled for months, we filled seven senior Java positions, including a tech lead, in just four weeks. This case highlights how our structured approach consistently delivers results even in highly competitive talent markets.

Job boards and standard outreach fail to reach highly skilled professionals who are already employed but open to the right opportunity. Many of these candidates prefer discreet approaches and rarely engage with public postings.

By leveraging a 65000-strong vetted candidate network and activating niche engineering communities, from GitHub and Stack Overflow to regional tech meetups and invite-only Slack groups, DevsData LLC consistently taps into the passive market that in-house teams often miss.

Even when companies find applicants, internal vetting processes are often inconsistent and unable to measure proficiency in new or emerging technologies. Many interviews still rely on outdated checklists, overlooking adaptability, problem-solving, and real-world application of skills. As a result, businesses risk hiring candidates who appear qualified on paper but cannot keep pace with evolving demands.

Every candidate at DevsData LLC goes through multi-stage vetting, including a 90-minute technical interview with senior engineers, ensuring hires can handle not only today’s requirements but also adapt to tomorrow’s challenges. Beyond technical depth, we assess curiosity, learning agility, and communication, which are critical for long-term success. This approach helps companies build teams that remain resilient even as technology shifts.

Hiring isn’t just about technical ability – distributed teams often face challenges with cross-cultural collaboration, communication, and alignment across time zones. At DevsData LLC, we specialize in targeted recruitment campaigns that account for both technical and operational fit, ensuring candidates are not only strong engineers but also effective contributors in distributed environments.

For example, when supporting SyrenCloud, a US-based data company, we conducted a regionally targeted recruitment drive in Brazil, Mexico, and Colombia. This strategy secured three backend engineers who matched the required technical stack while also working in time zones aligned with US teams, enabling smoother collaboration and faster project delivery.

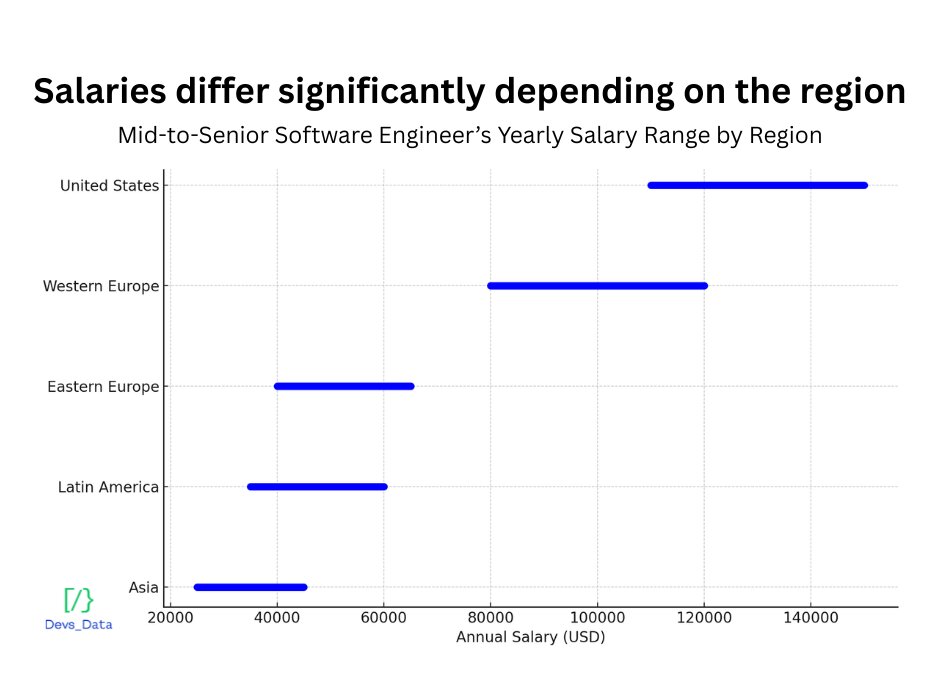

One of the most common questions companies face when planning technology hires is how much they should expect to pay in different regions. Salaries for software engineers and IT specialists vary widely depending on geography, cost of living, and local demand. For businesses expanding internationally or considering distributed teams, understanding these differences is critical for both budgeting and long-term workforce planning.

The salary ranges below are estimates based on data from sources such as Glassdoor, Payscale, and industry job market reports. They should be treated as indicative benchmarks rather than fixed standards, since actual compensation depends on company size, seniority, and local market dynamics.

United States

The US is the most expensive market for technology hiring, with mid-to-senior engineers typically earning between $110000 and $150000 annually. Salaries peak in hubs like California and New York, where Big Tech and fast-scaling startups intensify competition. Beyond base pay, employers must factor in benefits, equity, and compliance costs, which push total compensation even higher.

Western Europe

In countries like the UK, Germany, and France, salaries range from $80000 to $120000. Capital cities such as London, Berlin, and Paris command the highest pay, reflecting strong developer ecosystems but also intense competition from multinational corporations. Recruitment here is further shaped by strict labor laws and language diversity, which can slow down the process.

Eastern Europe

Markets such as Poland, Romania, and Bulgaria remain popular nearshore options for EU and UK companies. Engineers typically earn $40000 to $65000, offering excellent value relative to their technical expertise. The region’s strengths include cultural proximity, time zone overlap, and strong English proficiency, though rising demand from Western employers is gradually pushing salaries upward.

Latin America

Countries like Brazil, Mexico, and Colombia are increasingly competitive, with engineers earning $35000 to $60000 annually. The region’s biggest advantage is time

zone alignment with the US, making real-time collaboration easier. Talent here is strong in cloud, mobile, and backend engineering. However, varying English proficiency and economic fluctuations can impact consistency, which is why selective vetting is key.

Asia

With salaries between $25000 and $45000, countries like India, Vietnam, and the Philippines remain the most cost-efficient markets for IT services. India leads in scale, while Vietnam and the Philippines are emerging as niche leaders in areas like gaming, software development, and customer-facing platforms. The trade-off is variability in quality – rigorous vetting is essential to distinguish top-tier engineers from less experienced candidates.

This infographic illustrates why global recruitment strategies have become mainstream. A senior engineer in Warsaw or São Paulo may earn less than half of their counterparts in San Francisco while offering comparable technical skills. For many companies, this difference makes distributed teams not just a cost-saving measure but a strategic advantage that allows for reinvestment into product development, marketing, or further scaling.

At DevsData LLC, we’ve seen clients reduce hiring costs by 40-60 percent simply by expanding their recruitment reach to Eastern Europe or Latin America, without sacrificing technical quality. The key, however, lies in vetting. Lower costs only translate into value when the recruitment partner can guarantee strong technical ability, cultural fit, and retention, which is why our multi-stage process remains central to every project we take on.

When companies face hiring needs, they often debate whether to rely on their own in-house recruitment teams or to partner with specialized IT staffing agencies. Both models have their merits, but their effectiveness depends heavily on context.

In-house recruitment offers a clear advantage when hiring needs are steady and predictable. Companies that recruit at a consistent pace, and mainly for roles within a single location, can justify building and maintaining an internal team. These recruiters understand the company’s culture intimately and can integrate closely with hiring managers. For example, a mid-sized software house hiring a few engineers every quarter may find in-house recruitment cost-effective and sufficient.

The limitations appear when speed, scale, or specialization come into play. Niche roles such as senior data scientists, cybersecurity experts, or blockchain developers are notoriously difficult to source, and in-house teams often lack the reach or technical evaluation expertise to assess these candidates properly. Scaling across borders presents another hurdle: expanding into a new region requires knowledge of local salary benchmarks, compliance rules, and talent availability that internal recruiters rarely have.

Specialized recruitment agencies provide a clear edge by offering access to wider talent pools, faster delivery, and rigorous technical vetting. Unlike generalist recruiters, they understand niche roles, compliance requirements, and the urgency of scaling teams under pressure. Their strengths lie in speed, depth of expertise, and global reach, though they may come at a higher upfront cost compared to internal teams.

For example, Roche, one of the world’s largest pharmaceutical companies, needed highly skilled engineers to support urgent digital projects. Partnering with DevsData LLC, the company secured critical hires in just two months – a timeline that would have been nearly impossible through traditional methods.

In-house vs. IT staffing agencies

| Factor | In-house teams | Specialized staffing agencies |

|---|---|---|

| Best for | Steady, predictable hiring needs | Urgent, niche, or large-scale hiring |

| Speed | Slower; months for hard-to-fill roles | Faster; shortlists in days or weeks |

| Talent reach | Limited to local/network sourcing | Global networks, access to passive candidates |

| Expertise | Strong cultural alignment, but weaker in niche tech vetting | Deep technical screening and compliance knowledge |

| Cost | Lower ongoing cost if hiring is stable | Higher upfront fees, but faster ROI on critical roles |

| Risk exposure | Higher risk of failed hires and prolonged vacancies, increasing opportunity cost | Lower hiring risk due to vetting; reduced cost of mis-hires and faster time-to-productivity |

Selecting the right recruitment partner can determine whether a hiring effort succeeds or stalls. The strongest agencies are not just CV suppliers; they act as strategic collaborators who align with your business goals.

Look for alignment and understanding

A good partner starts by listening – learning about your company’s goals, culture, and long-term vision. To verify this, pay attention to their discovery process: do they ask detailed questions about your tech stack, team dynamics, and growth roadmap, or do they jump straight to showing CVs? Agencies that take time to map your hiring priorities before sourcing are more likely to deliver long-term fits.

Evaluate network and vetting rigor

The best vendors combine a broad candidate network with rigorous screening processes. When assessing a potential partner, ask about the size and makeup of their network (e.g., regional reach, access to passive talent, niche communities like GitHub or Kaggle). Request a walkthrough of their vetting stages, from technical interviews to problem-solving assessments, and ask for sample, anonymized scorecards. This will show you whether their process goes beyond keyword-matching résumés.

Prioritize transparency and industry expertise

Clear pricing, open communication, and no hidden clauses ensure smooth collaboration. To test transparency, ask for a breakdown of their fee model and whether they offer success-based pricing or guarantee periods. In practice, contingency or success-fee recruitment typically ranges from 15-30% of the hired candidate’s annual salary, with guarantee periods commonly spanning 60-90 days for permanent roles.

For industry expertise, review their past case studies: have they placed roles in cloud engineering, data science, or cybersecurity? Do their recruiters have technical backgrounds or access to senior engineers for interviews? An agency that can provide concrete examples and connect you with references is far more reliable than one that speaks only in general terms.

Choosing a recruitment partner should feel less like adding capability to your team, not outsourcing it.

The right vendor reduces the burden on managers, shortens time-to-hire, and opens access to talent pools you wouldn’t reach alone.

Website: www.devsdata.com

Team size: ~60 employees

Founded: 2016

Headquarters: Brooklyn, NY, and Warsaw, Poland

At DevsData LLC, technology recruitment is not just a service but our core expertise. With more than nine years of experience in the market and a government-approved license for recruitment services, we provide companies with a trusted, fully compliant partner.

Our recruitment process is deliberately selective. Out of thousands of applicants, fewer than 6% make it through our multi-stage pipeline, which includes a problem-solving challenge and a 90-minute technical interview led by a senior engineer. This rigor ensures that the candidates we present are not only technically capable but also strong communicators who can integrate smoothly into client teams.

DevsData LLC also stands by the quality of every hire. Our replacement guarantee functions as a risk-reversal mechanism: if a candidate does not prove to be the right fit, we provide a replacement at no additional cost, protecting clients from the financial and operational risk of a mis-hire. This commitment to long-term results has earned DevsData LLC a 5/5 rating on Clutch and GoodFirms, with 100% client satisfaction across reviewed projects – reflecting the trust companies place in our ability to deliver talent that drives lasting success.

Our experience spans global corporate clients and high-growth startups in the US, Israel, and Europe. One example is Pragmile, a Polish FinTech consultancy that required three senior Java developers with more than ten years of experience each, all based locally and hired within one month. The challenge was significant: the engineers had to stabilize a complex legacy monolith while simultaneously guiding its transition to microservices – a task demanding deep architectural expertise, long-term reliability, and the ability to integrate into distributed Agile teams. DevsData LLC managed the recruitment end-to-end, filtering 80+ candidates down to the three long-term hires who met these strict requirements and remained with the client throughout the two-year engagement.

Due to the strict requirements, Poland-based candidates with more than ten years of Java experience and strong architectural skills, the recruitment process had to be highly focused. We leveraged a structured, multi-stage evaluation to identify professionals capable of contributing to both legacy system maintenance and microservices development within distributed Agile teams.

With a network of 65000 vetted professionals and a team of specialized recruiters (including US-based staff), we source talent across key markets in Europe, the US, and Latin America. Nearly half of our placements are completed in under ten days, helping clients avoid costly delays and keep critical projects on track. And because we operate on a success-fee model with a guarantee period, our incentives are fully aligned with our clients’ long-term success.

Do you have IT recruitment needs?

Ready to scale your team with top global talent? Contact us at general@devsdata.com or visit www.devsdata.com to schedule a consultation.

The pressure to secure top technology talent is only increasing. With demand for software engineers, data scientists, and cloud experts outpacing supply worldwide, companies can no longer rely on traditional recruitment methods alone. Technology recruitment and IT staffing offer a faster, more targeted way to fill critical roles – whether for a startup scaling rapidly, an enterprise expanding across borders, or a global corporation modernizing legacy systems.

The choice between in-house recruitment and external partners depends on context, but the advantages of working with a specialized agency are clear when speed, scale, or niche expertise are required. Case studies with Roche, BNP Paribas, SyrenCloud, and Pragmile show how DevsData LLC’s global reach, rigorous vetting, and industry knowledge consistently deliver results, even under tight deadlines and complex requirements.

Successful recruitment is about hiring the right. With a proven process, a vetted network of professionals, and a commitment to client satisfaction, DevsData LLC helps businesses build teams that drive long-term success. In a market defined by both opportunity and uncertainty, choosing the right recruitment partner is one of the most strategic decisions a company can make.

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)